by |Dr Aini Abdullah, ainiabdullah@might.org.my

When asked what the single most significant factor is to influence fashion today, famed fashion designer Donatella Versace answered ‘Technology’.

Once strange bedfellows, technology and fashion have experienced far greater convergence than at any other time in history. The fashion industry epitomises an extreme end of retailing, banking almost entirely on speed and accuracy in a fast-moving, highly creative environment. Worth $533 billion in 2018, the global online fashion market is predicted to grow to $872 billion by 2023.

The playing field however, is brutally competitive with more than 1,875 fashion retailers shutting down in the last year alone. Miscalculations cost companies dearly. Understanding consumer wants is key, along with the considerations for pricing-points and affordability, a supply-chain with creative content that changes on a weekly basis and a distribution infrastructure serving a client-based increasingly raised on instant gratification.

To illustrate the magnitude of the issue, in March 2018 The New York Times reported that H&M had on hand $4.3 billion worth of unsold inventory. This was followed by a report by Business Insider four months later that Under Armour had unsold inventory in excess of $1.3 billion. Typically, the unsold inventory will make its way to discount centres to offset losses.

Enter technology

Technology seems an obvious solution. It creates more streamlined and efficient processes, allows for faster turnaround time and in the process revolutionizes how industries operate. Data analytics and artificial intelligence (AI) allow companies to create goods that fit consumer purchasing patterns, thus minimising wastage and keeping costs low. Smart Contract, a block-chain based computer protocol digitally facilitates, verifies and enforces the negotiation or performance of a contract. This saves both time and money when executed across the multiple contracts between manufacturers, retailers and logistic operators and minimises problems of invoicing data and tracking multiple vendors worldwide.

Growth of e-commerce

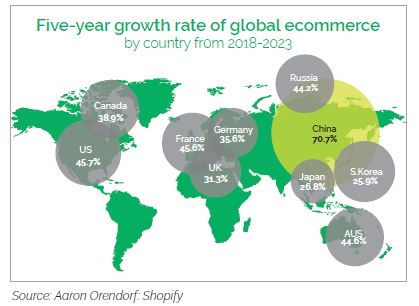

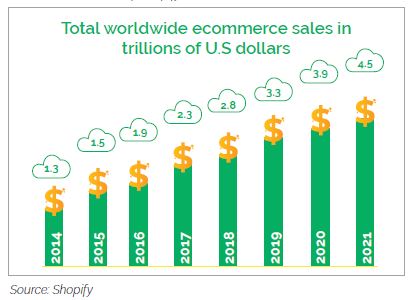

The fashion industry is not alone in its battle to adapt to the retail and commercial seismic shifts. Advances in technology, logistics, payments and trust, coupled with increasing internet and mobile access and consumer demand for convenience have created a US$3.3 trillion global online shopping arena, where millions of consumers no longer ‘go’ shopping, but literally ‘are’ shopping. This is expected to grow further as 1.4 billion people join the global middle class by 2020 out of which 85% will be in the Asia Pacific region. By 2022 e-retail revenues are projected to grow to USD 6.54 trillion.

Technological considerations aside, the shift to online commerce was greatly fuelled by the desire for time-flexibility and cost savings. In more densely populated countries like China, India and Singapore, avoiding the crowds was a strong motivation.

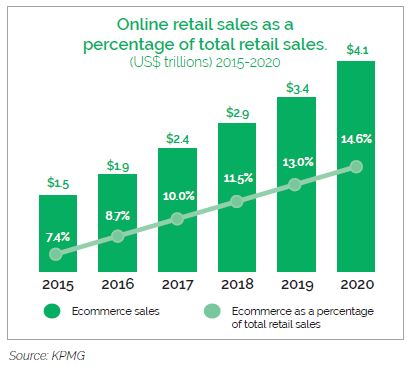

Brick-and-mortar businesses still dominate and are not losing their pull as yet. In 2019 online sales still account for only 13.0% of global retail sales, far behind more traditional physical business outlets. Its growth potential at 15% year-on-year however, promises to considerably change this in the near future.

Closing the browser to buyer divide

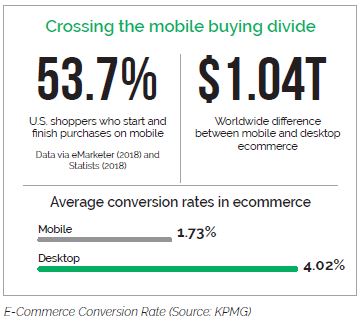

Further examination into consumer spending habits especially as regards the purchasing platforms, reveal that among the electronic platforms, desktop PCs or laptops are still the device of choice among 57 percent of online purchasers globally. 17 percent stated a preference for mobile device while 27 percent had no preference either way. Asian consumers are more than twice as likely (19 percent) as the global average (8 percent) to shop on a smart phone, especially in China, where 26 percent favoured mobile devices.

Today, it is estimated that more than 5 billion people have mobile devices, and over half of these connections are smartphones. Not surprisingly the millennials are most likely to use a smartphone for shopping (11 percent of recent purchases).

This compels e-commerce merchants to examine a key issue in online purchasing, especially in the use of smartphones as a purchasing device—the conversion rate. Conversion rate, the percentage of visitors to a website that completes a purchase is the most desired outcome in online retail. A high conversion translates into more value from a customer and lower rate customer acquisition costs.

For every three successful purchases from an online store, about seven end up in an abandoned cart. In 2006, the average cart abandonment rate was 59.8%. This increased to 69.23% by 2017 which translates into approximately $18 billion of unrealised revenue. More than 60% of consumers who abandoned their carts did so because of shipping costs, while 57% say they were “window shopping.” Worldwide, mobile sales trail desktop by over one trillion dollars and mobile conversion rates are less than half those of desktop.

Improving the consumer experience

Quite simply, the challenge for online retailers, like businesses on any other platform is to create a one-two of successful purchase and customer loyalty; and like any business, good user experience is key.

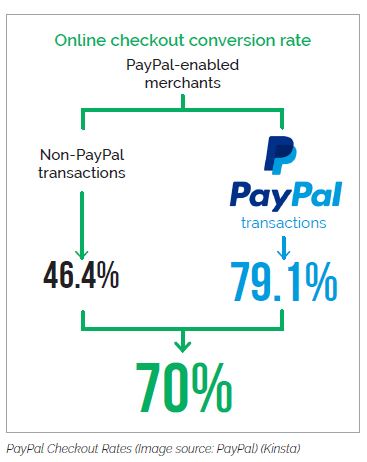

Consumer centric marketing geared towards better conversion rate includes wider use of shopping apps, fast website loading time, cleaner storefronts with better visuals and storing account information, which allow users to minimise typing. Additionally, better return processes and shipping costs help to further reduce ‘barriers’ to making and completing online transactions. The experience of ‘the last mile’ cannot be underestimated. Customers seek for clear information on efficiency of product delivery and ease of payment. PayPal transactions for example, have 70% higher checkout rates than non-Paypal transactions.

Long wait times for customer service or product enquiries lead to customer quickly losing interest. AI has largely circumvented this through the use of chatbots and virtual assistants. It is expected that by 2020, 85 percent of customer relationships will be managed without human interaction. AI also personalises content again to continuously hold customers’ interests by pushing relevant content e.g. recommended videos and movies on YouTube and Netflix; recommended music on Spotify and recommended products on Amazon.

Loyalty – keep them coming back

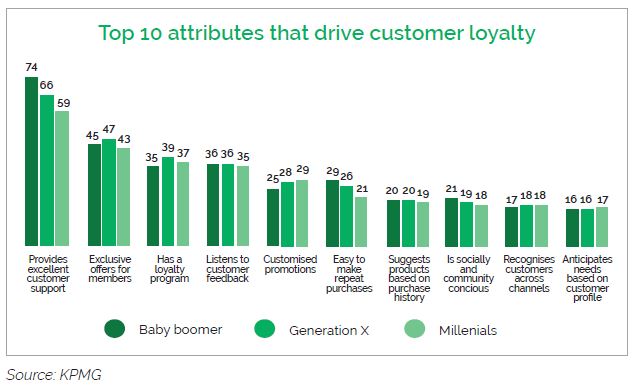

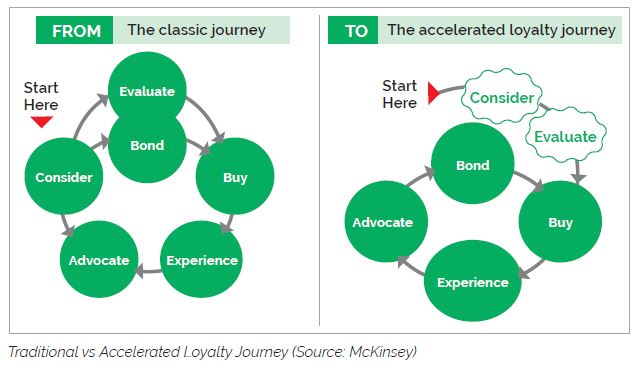

Smartphones and the internet have unlocked information and decision power that changed the interaction between consumers and businesses. Traditionally, consumers go through a linear process of familiarisation and on to deliberation and purchase. If the experience is a positive one, it will be positively evaluated to form a bond and loyalty. At any one of these steps, the customers may ‘drop off’ and marketers’ main purpose is to ensure that these drop-offs do not occur.

The internet has created a non-linearity in consumer purchasing behaviour in that the modern consumer decision process is much more iterative. Consumers today hop between different stages of the cycle between multiple companies—cutting short the route to loyalty and subsequent purchases.

More importantly, while providing information to aid a customer’s evaluation of a company’s product, this new ‘accelerated loyalty’ model once again greatly emphasizes the importance of speed and accuracy. Information must be aggressively pushed to the consumers at the exact moment their needs are generated. Delivering it fast to the targeted market segment allows customers to take immediate action and pursue an intended purchase. Once again, advanced technologies such as machine learning and AI have enabled ‘hyper-speed targeting’, thus marking a new age of marketing automation and acceleration. Companies that optimise the consumer decision journey by compressing or in some cases eliminating the consideration and evaluation phases will enjoy competitive advantage.

In the final analysis, success in online commerce will still depend on companies adopting cost-effective methods of providing goods and services and offering those at competitive prices. Companies poised for success however will be those which develop offerings and strategies that are market specific and are able to deliver them at hyper-speed.