By | Ahmad Redzuan Sidek | ahmadredzuan@venturetech.,my

Building a formidable leadership in high value economy has been the Malaysia’s strategic move since 1980s. The shift aims to grow the nation as an innovation-driven developed country. With this vision, the development of technology-driven SMEs forms an integral part of transforming the Malaysian economic ecosystem into a higher growth trajectory. The Eleventh Malaysia Plan Mid-Term Review (RMK-11 MTR) for the period 2018-2020 has also re-emphasised the need to invest in high value added and high-tech SMEs in promoting inclusive development and wellbeing of the Rakyat. (Source: EPU, 2018)

VentureTECH (previously known as A-Bio) was established as a developmental investment entity to encourage the participation of Malaysian entrepreneurs and SMEs in high value-added and high technology industries in Malaysia. Initiated by the Government as a strategic high impact program directly under the purview of the Economic Planning Unit (EPU), VentureTECH was incorporated as a wholly-owned subsidiary of MIGHT (Malaysian Industry-Government Group for High Technology).

While the original intent was to help transform the Bumiputera Commercial and Industrial Community (BCIC) in targeted emerging sectors, over the years VentureTECH has evolved and expanded its scope, but it remains committed in empowering Bumiputera industrial community towards balancing sustainable equittable growth and socio-economic development.

At the heart of VentureTECH is its mandate and aspiration to be a game changer in the nation’s quest to increase the number of high-tech companies in the country. In order to achieve its national mandate, VentureTECH strategizes its investments to address critical gaps in the ecosystem—funding, marketing, technology and entrepreneurship skillsets, in a strategic and holistic manner. In doing so, it complements other national initiatives aimed at optimizing the country’s intrinsic strengths and economic potential by pushing into new frontiers of high-tech industries and tapping on the new markets. It is the company’s investment principle not to just seek profitability. The bigger agenda is to select and support commercially viable ventures with high socio-economic multipliers and impact. More importantly, it looks for ventures that are spearheaded by dynamic, resilient and visionary entrepreneurs that share VentureTECH’s values and aspiration, which is to build iconic Malaysian companies, that would eventually become world players.

The company relentlessly pursues value creating partnerships. It does not want to be known as just another investment company. This is where the company always strives to align its commercially driven processes along with the national mandate to catalyse the growth of local entrepreneurial capacity in high-tech industries through direct nurturing.

This also means that the company has to strategize holistically and invest in only a selective group of companies. These are companies which have not only shown probability to generate great return on investment, but are also in the best position to deliver positive spill over effects to the industries and economy and the larger community as a whole. Throughout its investment tenure, VentureTECH works hand-in-hand with the management teams of its portfolio companies. The aim is to strengthen the companies’ business practices and financial position, creating value throughout every development step. Significantly, VentureTECH has a long history of doing just that.

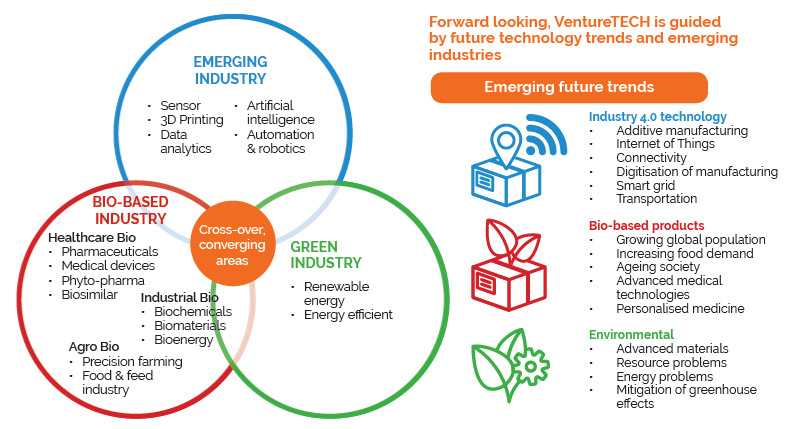

VentureTECH places a high priority on three major industry sectors; the emerging industry, bio-based industry and green industry. The emerging industry sector includes the likes of advanced sensors, 3D printing, data analytics, automation & robotics and Artificial intelligence (AI). Leveraging Industry 4.0 trends taking off globally. The bio-based industry covers niche sub-sectors such as healthcare bio, and industrial bio that promoted green material and green chemical products. There are also cross-over converging areas in the three sectors. This is summarised in the figure below:

VentureTECH investee companies are market leaders

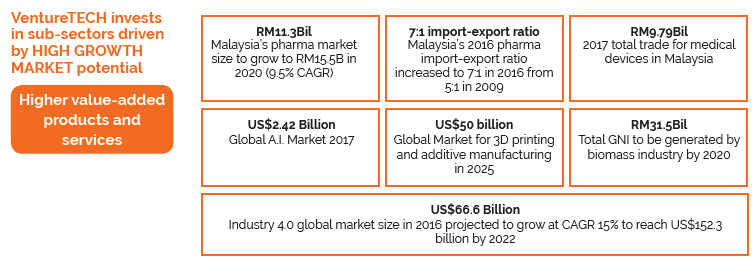

VentureTECH is positioning itself as a company to help Malaysia capture a sizeable share of the global business shaped by new emerging technologies.

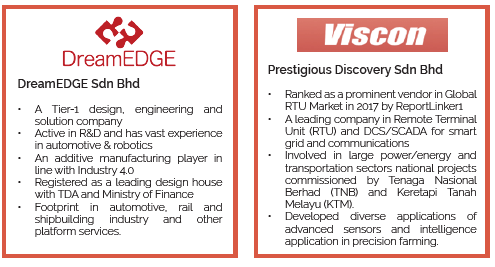

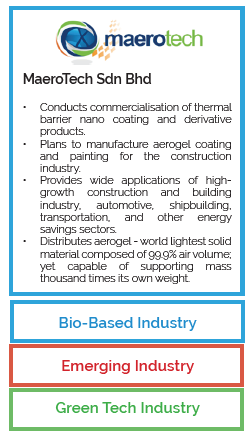

VentureTECH portfolio companies consist of market leaders in various niche areas, managed and owned by reputable, genuine and tech-savvy entrepreneurs and their strategic JV companies. These include:

VentureTECH is well placed to play a strategic role in helping the nation grow technology-driven SMEs to diversify its economy. With the right focus, VentureTECH carefully selects businesses that deal with new technologies in line with global trends. These businesses are more effective in addressing pressing global concerns around climate change, depleting natural resources, changing demographics and an expanding global population.

To make an enduring contribution to the nation’s economy, VentureTECH’s dynamic team takes ownership in ramping up local tech-driven SMEs resilience. All of this is pointing toward a sustainable future. Significantly, VentureTECH’s professional board of directors places integrity as a core value and exerts a strong believe in the importance of building the nation’s local industry champions to help transform Malaysia’s high-tech industries.

References:

1. https://www.prnewswire.com/news-releases/global-intelligent-remote-terminal-unit-market-2017-2021-300424356.html

2. https://www.zionmarketresearch.com/news/biomass-pellets-market

3.https://static1.squarespace.com/static/5a0cca3fb07869afe916d8f6/t/5afa6faeaa4a9925e9386ed3/1526362048214/0900-Wed-CR123-Dougan.pdf