by | SRI WIDIAS TUTI ASNAM RAJO INTAN, sriwidias@might.org.my

Overview

As COVID19 continues to disrupt the global economy, the ship building and ship repair (SBSR) industry has not been spared by its after-effects. In a way, this has put many global industries in a transition, anticipating newer technology, practices, and processes will provide them an uplift in the future. Despite this, many SBSR companies have flattened and this transition does not always imply progress. The truth is, local SBSR companies still grapple with numerous challenges that are being driven primarily by a highly fragmented industry structure and thus, progress comes with the risk of backsliding into slow recoveries.

Clearly, this scenario underlines the need for new strategies. After the pandemic arrived, three strategies for restarting the economy have emerged to fight and resist economic downturn. To move past these obstacles, this demands local SBSR companies to be prepared to turn the challenges into opportunities and this is going to be fuelled by cost-reduction potential. While recovery will no doubt take strenuous work, by shifting towards new ways of doing things, Malaysia’s domestic SBSR industry can complement growth with predictable revenue streams. Ultimately, by incorporating the new, the local industry can plan for a stronger future amid rising operational complexity.

Unpacking the numbers and figures facing the industry’s fight to recovery

The market is expected to decline from $192 billion in 2019 to $177.9 billion in 2020 at a compound annual growth rate (CAGR) of -7.4%. This decline is mainly due to economic slowdown following COVID19’s outbreak and the measures taken to contain it. Now, the market is expected to recover and grow at a CAGR of 3% from 2021 and reach $191.9 billion in 2023. Currently, Asia Pacific is the largest region in the global SBSR market, accounting for 51% of the market share in 2019 followed by Western Europe with a 20% market share. Meanwhile, Africa is the smallest.

For Malaysia, prior to COVID19, SBSR companies had already envisaged the future as a survival struggle. Between mid-2014 and early 2016, the global economy faced one of the largest oil-price shocks in modern history—a 70 percent price drop over the two-year period. Since, industry players have faced a difficult time. The significant drop in the number of new build orders is an alarming indicator. Worse yet, SBSR companies are securing fewer jobs from key sectors such as oil & gas sector apart from battling overcapacity and dependency on government SBSR projects. However, contrary to the news or public opinion, to stay afloat, local SBSR players should instead focus on capitalising domestic market opportunities.

Post COVID19 recovery: Implementing new ideas and technologies to freshen up an underwhelming industry

The three lenses for building a secure future for Malaysia’s SBSR industry

- Reorganise the industry through technology

Surely, the crisis is an opportunity for SBSR companies and talents to reinvent themselves. Yet, there is no better time to do so than now. In light of this, the snapshot below focusses on some of the industry’s lowlights and challenges that must be addressed by a rapid uptake of new technology and people-oriented practices.

- The SBSR industry is too labour dependent.

- Over reliance on foreign vessel design expertise and global supply chains for parts, raw materials and components make the industry vulnerable and less resilient compared to its competitors.

- The industry’s strategies are mired in traditional ways and lack technology leadership.

- Companies are cautious to invest because many are cash-strapped in today’s circumstances.

- Some shipyards are wary of using new technologies due to a lack of knowledge.

- Vessels’ unique designs and systems make automation limited to welding and steel plate pre-processing functions. Thus, applying new methods in new areas pose a steep challenge for local SBSR operators.

- Many SBSR companies are unable to implement new technologies because of cost-prohibitive investment.

- The cost of adopting digital solutions such as 3D Digital Twin design is negligible.

- However, the costs of poor quality construction, variation orders, rework, mistake repairs, late delivery, waste and so on account for about 15% to 20% of local yards operating costs. All these will cost more than adopting new technologies such as VR, AR, 3D printing and robotic welding to eliminate these said shortcomings.

2. Productivity Gain

The coronavirus pandemic has largely warped the industry’s productivity. At the same time, this new reality has also magnified the importance of implementing new technology to achieve higher productivity gain. This effort however must be approached objectively, measured frequently and implemented widely in areas where it is critical. But that’s hardly the whole of it. In the future, the battle for competitive edge between Malaysia’s SBSR industry and its competitors will be decided by technology-driven innovation. Technological excellence alone may not be enough to achieve an energetic circle of growth. Therefore, it is very important for local SBSR companies to shift their focus to small wins and this is where higher productivity can give them the upper hand.

- The Industry needs to embrace technology for higher productivity gain.

- Today, digitalisation is a crucial enabler of higher productivity and efficiency.

- For local SBSR companies, the most accessible technology upgrade is digitalisation. For example, 3D Digital Twin design and Product Life Cycle are the latest and most effective digital solutions. However, these solutions present today’s prerequisite upgrade to high productivity and competitiveness.

- Robotics can be widely used in the industry for heavy functions that are prone to human errors such as lifting heavy metal parts.

- Robotics increases efficiency and reduces accidents.

- Automation in services such as welding, blasting and painting need to be a common sight across local shipyards in order to be competitive.

- At South Korea’s Geoje shipyard, 68% of its production processes are carried out by robotic systems.

- Product Lifecycle Management (PLM) offers a huge potential for process improvements and cost savings.

3. Supply chain support

For the local SBSR industry to recover and sustain growth, varying levels of support should be available to all industry players, regardless of their worth or importance to the supply chain’s value. In addition, government contract, procurement and tender practices should be further streamlined to ensure Malaysia’s public sector fully supports industry growth and development. In Malaysia, the unique composition of local and government-owned SBSR players run almost the full spectrum of the industry. Therefore, the government needs to introduce a new normal for government contract acquisitions to ensure good governance, growth and sustainability.

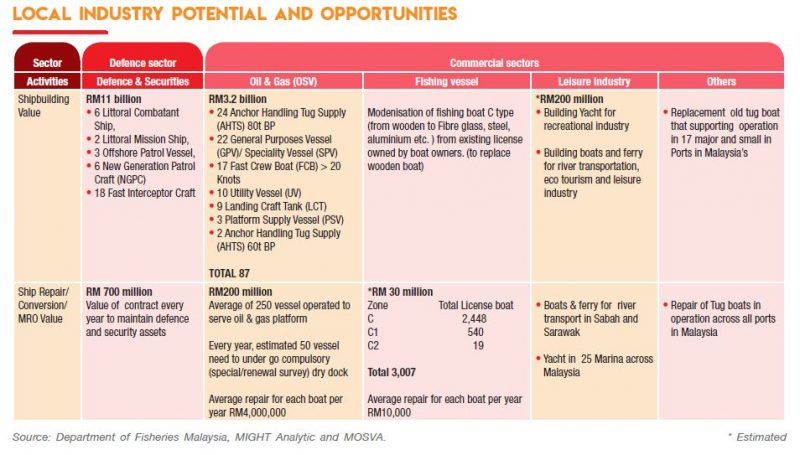

Local market opportunities

Projecting clear convictions is important to grow the local industry. Looking at the local industry’s figures between 2018 and 2020, there are obviously many pockets of opportunities for local SBSR companies. Despite a gloomy global outlook, the vigour of domestic commercial and defence sectors’ long-term growth remains intact. Also, these sectors offer local players numerous routes to organic growth. However, to help local SBSR companies thrive, this will require a policy tilt by our lawmakers. For example, the government needs to introduce measures that will reduce our local maritime industry’s reliance on foreign vessels. But the caveat here is, our local players need to step up their game.

Interestingly, now, there are 31 marinas located throughout Malaysia’s shorelines. This favourable ecosystem presents abundant of cross-sector opportunities for local SBSR and tourism industries’ players such as yacht rental, maintenance and repair. This will also open up many new opportunities for leisure activities around these locations.

Conclusion

By and large, the industry now is more about surviving a rising tide that’s looming ahead, less so about getting the industry to mature into new ways and trends. Despite this, there is still enormous potential for Malaysia’s SBSR industry. Of course, the key opportunity lies in creating clearly defined goals skewed towards capturing local opportunities and then expand them globally.

On the road to recovery however, the journey lies between promise and reality. It is long and winding, and full of potholes. However, there are clear dangers in ignoring what’s happening around global trends reshaping the industry in order for our local SBSR companies to remain relevant. One thing is for sure, the industry is in need of a rapid uptake of new technology and this should be propelled at a manageable speed. At the same time, there should be a clearer delineation of roles for government-owned SBSR companies tasked with scaling up the industry. So much so, how things shake out regarding what our government-owned SBSR companies do will largely determine the fate of our domestic SBSR industry. Taking into account post COVID19’s new norms, local SBSR companies should tap into the disruptive digitalisation forces of the industry. A major overhaul is indeed needed to advance the industry to the next level to stay on par with global players.