by | NORSAM TASLI MOHD RAZALI, norsamtasli@might.org.my

Introduction

Over the years, the Malaysian public service has undergone a defining phase. Quite tellingly, it has survived a long list of acid tests where the sector’s capability, efficiency and financial management were put under pressing political and public microscopes. While the public has always been quick to raise criticism of government services and delivery, yet, the challenges thrown at the public sector in the years since have built resilience into it. For example, the sector has been far more adept at reacting and responding to public pressures and constantly changing political will. But when the complexities at play were studied, the public sector was discovered to be highly prone to corruption. Understandably, this is largely due to its weaknesses in financial management. Weak governance in procurement, legal enforcement and administration is often viewed as the sector’s Achilles heels.

These weaknesses however, perpetually challenge the integrity of the public service. As far as corruption is concerned, a total of 30 top public officials were arrested for corruption charges between 2015 to 2018. On another note, technology is one of the most difficult challenges facing public service’s financial management. In this regard, the Malaysian public service lacks infrastructure readiness and technical resources. Further, the low take up rate of technology adoption somewhat hinders the public service from reaping the full benefits of sophisticated financial planning and design.

Unpredictable financial turbulence

Natural disasters can cause unforeseen calamities often resulting in massive government spending bills. Unfortunate turn of events like flash floods can disrupt daily economic activities, damage infrastructure like roads, railway tracks, vehicles, properties and even cause loss of lives—thus inflicting national chaos. Foreseeably, the impact of COVID-19’s pandemic outbreak will not just impact local economies, but will also stutter the world economy when things return to normal. As the outbreak recedes, just months before, the Malaysian government has had to shift resources allocated for spurring economic growth to handle a sudden spike in healthcare expenses to fight the outbreak. While everyone is bracing themselves for an unprecedented financial turbulence caused by unemployment or a rush of businesses going bust, governments now have to provide a sizeable economic stimulus package to help citizens survive the outbreak. This situation has called for a serious overhaul of the public service’s financial management. By making sense of the unforeseen trends around COVID-19’s chain reactions, the public service can future-proof its readiness to help stretch its financial management ability in handling unforeseen circumstances that may arise in the future.

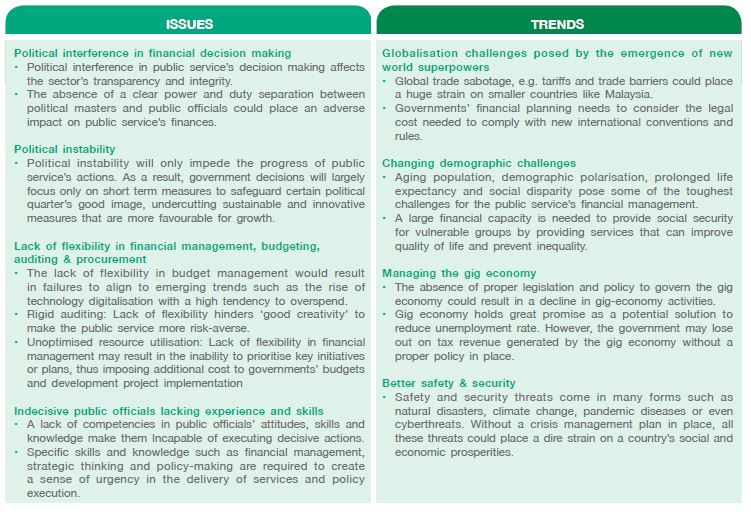

Discovering issues and trends

The following are issues and trends that affect the public service’s financial management efficiency.

Gearing up for change

Gearing up for change to improve public service’s financial management should focus on three determinants. Firstly, tackling integrity issues and promoting greater transparency are of utmost importance. Secondly, the public sector needs to explore innovative new ways to improve efficiency in financial governance and management. Thirdly, the sector needs to explore innovative new ways to plan and deliver its services.

Cultivating greater transparency in financial processes

Transparency is important to public service’s financial management. It reflects the sector’s accountability and integrity in managing and governing financial matters. Below are a few considerations that the public sector can review to improve its financial processes’ transparency.

- Enhance procurement decision-making through policy and public engagement: It is therefore crucial to implement a clear policy guideline in order to provide a well-defined demarcation of ministers and their political secretaries’ involvement roles in public service. Also, there is a moral imperative to implement an appropriate mechanism or platform to allow the public to get involved in procurement processes. In turn, this will improve procurement decision-making transparency as well as act as a check and balance measure visible to the public.

- Introduce a new legal framework and approach in managing public finance: A new legal framework for financial processes and designs can add depth to the accountability and transparency of public sector funds and resource management. For example, soon, the Malaysian government will introduce a Fiscal Responsibility Act (2021) to prevent uncontrolled spending in a bid to rein in the public sector’s mounting debts. In addition, an accrual accounting practice will also be introduced to enable a widely comprehensive management of public finance.

- Digitalisation of government financial systems: Changing manual financial processes to digital is a move that is urgently needed to increase efficiency and improve public sector transparency, especially concerning procurement. For example, an open platform that brings government buyers and digital sellers together simplifies the procurement process and makes it easier for businesses of all sizes to access government contracts. However, the public service needs an adequate allocation of funds to implement cybersecurity measures to safeguard government financial systems from cyber-attacks.

Enhancement in financial management efficiencies

To drive financial management efficiency, public service leaders need to target improvement in financial operating models and process designs. In part, this will consolidate existing processes, tackle lingering issues and bump up the sector’s preparation to deal with future uncertainties.

- Project enhancement through monitoring and evaluation: Any errors that occur should be measured against existing approaches and systems. In turn, this will make room for better approaches to be introduced. Creating a platform that allows widespread public participation is equally as important as having sound government systems. It must be noted that public service relies on feedback and participation from its stakeholders to improve its services.

- Preparation towards future uncertainties: To avoid ad-hoc financial aid straining government budgets, governments need to prepare for uncertainties that come from unforeseen shocks and unexpected events such as natural disasters. Events such as flash floods could cripple a country in just a matter of weeks. However, the consequences of such events are uncertain and are hard to gauge. Therefore, budgeting for disasters can prevent a budget disaster in the future. Financial readiness in emergency situations such as fighting a pandemic outbreak and bracing for economic shocks are similar in some ways to preparing to a natural disaster. Quite significantly, this will determine the vitality of a country’s economy and decide the fate of its citizens.

- Auditing improvement to reduce non-compliance risks: Public service’s auditing practices require some degree of flexibility and a good deal of creativity to improve financial design and planning. At best, the introduction of auditing compliance is necessary to mitigate any non-compliance risks throughout government projects’ implementation.

Innovative financial solutions

To refresh the public sector’s purpose and power, it needs fitting technology tools to unlock value-based services. At the same time, to raise revenue, the public sector needs to tune up its capability and adopt new approaches that can have a dramatic impact on service delivery.

- Develop a new business model to fund project implementation: Collaborative approaches and shared-funds can significantly reduce the burden of public sector projects. In terms of budget planning, governments should take into consideration providing cross-agency budgets to boost development outcomes. Alternative financing sources such as crowd funding for inter-agency projects can also be explored.

- Reassess the impact of technology in financial management: Technologies such as blockchain, big data, artificial intelligent and cloud computing provide access to a whole new suite of sophisticated solutions. Apart from what governments can do differently to achieve better results with technology, the aforementioned technology solutions are also compatible with most existing e-government platforms. As a result, governments can improve revenue collection through user-friendly means, reduce budget expenses and avoid overspending.

- Reduce public service financial burden: Given that the public sector is in desperate need of a reboot, it needs to identify a new circle of influence or create a new potential market for the private sector to invest in. Done right, this can generate a vibrant economic stimulant that supports the creation of more economic opportunities for the private sector. Alternatively, formulating a plan for action that leverages prevailing economic trends such as the gig-economy to outsource certain public sector roles can help reduce governments’ overhead costs. For example, getting social workers on board to aid government causes can help governments reduce their financial burden.

Conclusion

The promise of financial management sophistication can only be realised by having a clear view of the current economic landscape in order to understand where future opportunities lie. Significantly, this diagnostic aims to provide a quick snapshot of the public sector’s financial management to promote new planning and design approaches. Despite being bundled with a broad set of issues, the drawbacks or damages that had transpired over the years can be shifted towards the formulation of better future strategies. Last but not least, with better strategic approaches, governments can then discontinue ineffective strategies in order to prevent incurring bigger losses in the future.