by | NorFarkhana Mahfar

“The oil and gas (O&G) sector is the major contributor to Malaysia’s economy. It is noteworthy that, over the past decade, the oil, gas and energy sector contributes about 15% to Malaysia’s gross domestic product (GDP) and is expected to contribute up to 20% to the nation’s economy by 2020”

The demand for these precious hydrocarbons is forecasted to grow in tandem with the increase of world population and the needs like foods, shelter, cloths and etc.

The demand is strong, especially from the transport sector which makes up the bulk of global demand for O&G. As reported in World Oil Outlook 2013 by OPEC, 60% of the global demand for oil in 2012 came from the transport compared to 25% from industrial sector; 10% from residential, commercial and agricultural sectors; and 5% from electricity generation sector.

O&G and the Marine Industry

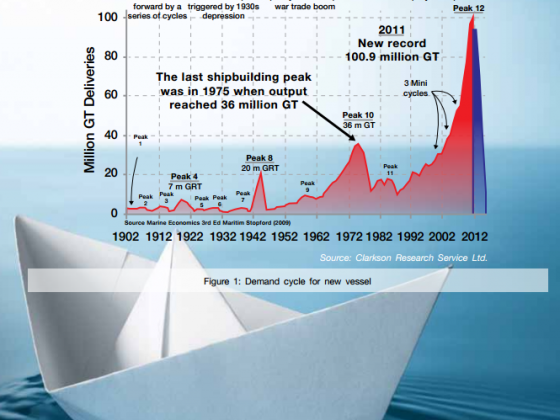

It is not an exaggeration to say that the marine industry is the backbone of the O&G sector as it requires various vessels and workboats to facilitate and carry out offshore exploration and production (E&P) activities. And, as Malaysia’s O&G sector progresses, more local companies are involved in shipbuilding, ship repairing, ship chartering, equipment manufacturing, ship management, crewing and marine surveying. The robust demand for various workboats in the offshore support vessel (OSV) category has seen several shipyards enjoying impressive revenues and healthy order books.

Shipbuilders’ role in supporting Malaysia’s offshore O&G sector is extremely important. Some of them even cater for the export market where, in 2013, RM193 million worth of offshore type vessels were exported by Malaysian shipyards. It also shows that Malaysian-made vessels are recognised and accepted worldwide as its quality meets international standards.

For the past few years, several local shipyards have also started to venture into offshore support activities such as structure fabrication, ship conversion (i.e. Floating Production Storage and Offloading, Floating Storage Offloading, Floating Storage Unit), rig building, platform repair and maintenance as well as ship chartering. The approach helps the shipyards to diversify their business and cut their dependency on shipbuilding and ship repair activities as the competition in these areas is increasing and the demand has started to decline.

Increasing E&P Cost

The days of ‘easy oil’ – oil found in abundance and in accessible areas – is coming to an end. Exploration to fid O&G need to be done in farther locations and in tougher conditions which include fields in ultra-deep waters with high contaminants and high temperature that pose enormous technical and physical challenges.

“Over the past decade the oil, gas and energy sector contributes about 15% to Malaysia’s gross domestic product (gdP) and is expected to contribute up to 20% to the nation’s economy by 2020.”

The more challenging demand to fid O&G in frontier fields increases the expectations of oil majors for more sophisticated OSV. Such vessels like anchor handlers, fast crew boats, supply vessels, accommodation vessels and various types of floaters have to feature the ability to carry greater volumes of cargos and passengers, have self-propelling ability, and sail at higher speed compared to existing vessels. Additionally, major oil companies are now seeking vessels with all-weather robustness that can help minimize health, safety and environment (HSE) risks and non-productive downtime. Consequently, the cost to carry out E&P activities is getting higher. The average cost of an asset used in the E&P of the sector is currently 300% higher than that of five years ago.

Major oil companies would also want to see shipyards enhancing their competitiveness and efficiency in servicing their vessel to reduce vessel downtime in facilitating E&P activities. In an initiative to reduce carbon footprint, oil majors are eyeing on greener vessels which not only help to protect the environment but also increase operational efficiency.

“Malaysia’s OSV Owners’ Association (OSV Malaysia) estimated 12% of OSVs in Malaysia had past their economic life and 21% are still useful but no longer competitive.”

Malaysia’s Marine Industry

Can Malaysia shipbuilders meet these demands?

Malaysia’s OSV Owners’ Association (OSV Malaysia) estimated 12% of OSVs in Malaysia had past their economic life and 21% are still useful but no longer competitive. On the positive note, this presents a great opportunity for fleet modernization and upgrading to lower the age of OSV.

Korea’s marine industry has improved rapidly making her a successful maritime nation. Therefore, it is not wrong to look at Korea as an example to improve our marine industry.

Looking at the Korean Best Practice (KBP) as an example, it is imperative to change the behaviour, mind-set and attitude of shipyard personnel to gear them towards a high performance working culture. The relentless commitment from the industry players must then be complemented by solid regulatory, institutional and organizational framework, and intensive use of technology and operations systems. The industry must work hand-in-hand with the Government and learning institutions for the betterment of the industry.

KBP has shown that one of the key ingredients to become a successful maritime nation is to master the design capability. Attaining in-house design of various types of vessel, especially OSV, will enable us to maximise our local content at the earliest design stages when primary parts, materials and equipment and the basic configuration are being decided. This will enable us to be competitive in terms of price.

Malaysia, apart from being an O&G hub, can also emerge as the hub for building and repairing high value-added vessels/assets such as drilling ships, FPSO, FLNG, jack-up rigs, MOPU and LNG-powered vessels. Taking the opportunity that has come forth, local shipyards should pursue collaboration opportunities with established foreign yards that have proven track records in building/servicing such ships and assets. Local shipbuilders should play a proactive role and position themselves to be at the forefront of shipping instead of ‘order takers’. This is achievable if local shipyards manage to become the best solution provider to specific needs of the shipping community.