by | Jonathan Calof, Jack E. Smith and Gregory Richards Telfer School of Management, University of Ottawa

Establishing industrial policy and its ensuing programs and industry assistance measures are fraught with high levels of uncertainty.

As will be shown in this article, through an integrated program involving foresight, intelligence and business analytics not only will it be able to decrease levels of uncertainty and risk, but these techniques should lead to increasing probabilities of policy uptake by its intended audience and also early identification of industry opportunities.

The authors of this article have been involved in hundreds of industrial policy and program projects around the world. We have seen programs succeed and we have seen far more fail and the purpose of this article is to propose a framework and series of tools designed to increase the chances of industrial policy success. Industrial policy and its ensuing industrial assistance measures, whether tax based or fiscal incentives, is designed for several broad purposes. To simplify this, for the purpose of this article, we will focus on what is emerging as a more common objective or outcome of the industrial policy which is to get domestic companies properly positioned for markets identified as high priority for the country

MALAYSIA AND INDUSTRIAL POLICY

In past years, Malaysia identified clean technology as a priority market and instituted several policy mechanisms including loan guarantees for eligible clean tech investments. During almost the same period, Russia invested approximately $5 billion in infrastructure spending and industrial investment in nano-technology. The intent of these policies and supporting programs is to ensure that the domestic environment provides the necessary support for the industry and that the countries’ companies develop the appropriate products/services for these markets. For the most part these programs and policies are intended to support the development of industry that will be either regionally or globally competitive. So, for this article we will not focus on industrial policy aimed at strengthening domestic industries selling to only domestic markets but on domestic industries selling in global or regional markets. This is certainly the case for Malaysia in clean technology as the intent of the program is to make Malaysian industry number 1 in Asia in certain clean technologies, not just in Malaysia. In the case of Russia it’s about global nanotechnology based product sales. Thus, for this article, the outcome of industrial policy will be defined as regionally or globally competitive domestic firms selling the targeted industry products or services.

TYPES OF INDUSTRIAL POLICY UNCERTAINTY

Developing industrial policy designed to develop innovative, science and technology related industry’s is fraught with significant uncertainty. This uncertainty arises for many reasons, from our experience; most of this is due to the fact that governments have very little true control over the program uptake and outcomes. In industrial policy, governments control the program design, its support elements and of course who gets the benefits. But the government does not control who applies for the program, whether the companies accept the program, and other such factors.

For example, when Malaysia launched its clean technology assistance program the government controlled what company investments would qualify for clean technology certification and whether they would get the loan guarantee and funding. But that is where their control ends.

For a program to succeed, many factors beyond the governments control must, in a sense, cooperate, and therein lies the uncertainty. Below are three types of these uncertainties:

a. Program uptake uncertainty: For the desired outcome of an industrial policy to arise, the domestic industry players must actually use the mechanism/s and do what the policy is intended to encourage them to do. Think of government policy as a program designed to change organizational behaviours. A loan guarantee program for example is designed to get banks to give loans that they otherwise would not have given out. Investment tax credits for research and development are designed to cause companies to do research in areas that previously they were not aware of or willing to invest in. Conceptually, the program is designed to cause the decision makers (industry) to make the decisions designed to support the government’s industrial policy outcomes by increasing the perceived attractiveness of these markets. But while the government does control the level of loan guarantee and the type of tax credit, it is ultimately the bank that decides if they will put the loans out and it is the company that decides if they will do the research and development. Government programs can encourage these actions, but if the companies do not make these decisions, the policy will fail. We have seen many government tax incentives, credits and loan programs around the world fail because the intended targets did not use the mechanisms; i.e. they had no desire or were not yet ready to make the decisions that the industrial policy was designed to support.

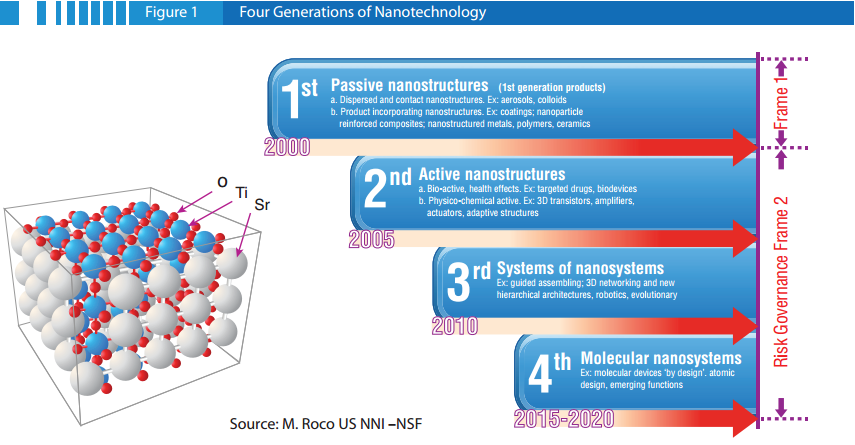

b. Domestic capacity uncertainty. Domestic industry players must have both the ability and the desire to do what the policy intends it to do. In the case of the Russian nanotechnology program the desire is for Russian companies to develop products that are nano enabled. By 2020 the hope is that they will have what is termed level 3 nano products (see table 1 for more on levels of nanotechnology). But even if the companies are interested in moving in that direction (point “A”) do they have the capacity? Do they have the ability? Too many times we have seen government programs specify targets and directions that the domestic industry does not have the capacity to meet within the program policy time frame

c. Time line induced market uncertainty: Once developed and implemented it takes many years till policies objectives are realized. Meanwhile as the policy is being designed and being implemented, markets evolve at increasingly faster rates, new competitors emerge, new technologies are created, customers’ needs change, some markets grow and others die, and so forth. When a government like Malaysia institutes a clean technology program they hope that the technologies it is designed to support are still commercially viable when the companies they are helping are ready to sell them. As it can take upwards of ten years between idea inception and commercialization this creates a lot of uncertainty because there are many factors that can change the industry in that time, and usually none of these are under the control of the Malaysian government (e.g. they have no control over what a company in the United States does in their R&D program or what a foreign government designs as its clean technology policy. For Russia’s nanotechnology program one of the support measures was to stimulate the development of nanotechnology university programs. While it takes four years to graduate someone with an undergraduate degree in nano-science, it also takes several years to create the program that will lead to these graduates. Given that the objective of industrial policy is to create future industry success, the longer the timeline between program development and eventual commercialization, the higher the uncertainty is – that by then the environment may have changed significantly. The uncertainty therefore lies in whether the industrial policy and programs being designed today which are designed to affect companies decisions upon program implementation (items a and b above) will fit with the global competitive environment at the end of the program timeline (when the products/services are ready for market). For Russia and nanotechnology the industrial programs are geared towards an environment envisioned in the year 2020.

The above only describes 3 of the elements of uncertainty that will impact industrial program success. Foresight, intelligence and business analytics provide important tools for reducing the uncertainty associated with these elements. In this article, readers will be shown how:

1) Foresight and intelligence can be used to identify where the industry is going is in the longer term. This increases certainty and understanding to look at what areas of the industry to actively support with policy and programs. These techniques will be shown to reduce timeline induced market uncertainty.

2) Intelligence and business analytics can be used to identify what instruments (programs and policies) need to be developed and how they should be designed to get industry to move in the direction identifid under number 1. These tools will be shown as a method to reduce program uptake uncertainty.

3) Intelligence and business analytics will also be used to determine if the program targets are reasonable. This is part of domestic capacity uncertainty

4) Finally ongoing foresight, intelligence and business analytics will be linked with the idea of an industrial policy dashboard to help policy makers monitor whether the program is still on track after the program is launched. Ongoing monitoring on the dashboard will result in continued reduction of uncertainties associated with program uptake, timeline and domestic capacity, and provide an early warning system to policy makers so that they will know early enough whether design or criteria changes to the industrial policy are needed.

A Case Example; Applying Foresight, Intelligence and Business Analytics (IFAB)

For the purposes of this article we will use Nutrapharmaceuticals as the basis for our industrial policy examination for the use of foresight, intelligence and business analytics. The use of nutra-pharmaceuticals is purely for demonstration purposes and is based on Malaysia having active involvement in this sector with an active industry, research and MOSTI’s Malaysian Institute of Pharmaceuticals and Nutraceuticals.

Foresight is about the application of collaborative, creative and analytic techniques to ensure longer term visions can be factored into improving short term decision-making. It a systematic multi-tools and perspectives approach based in science and early signals identification that enhances anticipatory capacity, examines readiness for change, and develops agility and mechanisms for coping with change to reduce surprise to business, government and society. Foresight is not prediction; – instead, it produces multiple, plausible, contingent scenarios, roadmaps and other directional guides to managing uncertainty by reducing the surprise aspects but not eliminating it.

Most advanced technology-based economies now have developed foresight programs to assist their industries cope with the speed and uncertainties of global competition.

So how for example, might a national foresight organization, concerned about the long term competitive viability of its nutra-pharmaceuticals sector approach the challenges of a rapidly changing technology landscape? More specifically, how should an industry department, already with a successful track record of nurturing the development of new nutra-pharma companies approach the complexity of deciding whether, when and how to invest in a new area of technological progress with potentially transformative applications?

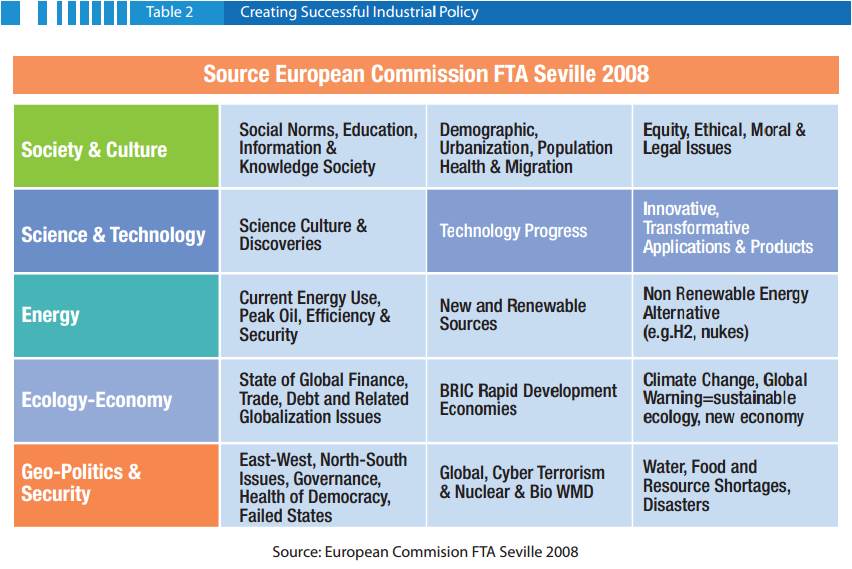

A first step would be to consult technology and environmental scanning reports similar to those categories highlighted in Table 2, below. (Table 2 was developed by organizers of the 2008 European Commission’s Future Technologies Assessment Conference overview report on the Big Picture Survey it sponsored.)

The survey uses five standard STEEP- type categories and then three sub-categories for each- with technology areas embedded in each sub area, and/or featured in the two yellow highlighted areas under Science and Technology). These foresight techniques would indicate, for example, that there exist real uncertainties about what applications might soon become both technically feasible and economically viable and whether there may be toxicological risks. Scanning would also indicate that there already is a growing global market in bio-nutraceuticals – and – that the application of molecular scale nano-engineering is progressing fast and could create enormous growth if and when successfully commercialized. Significant uncertainty however remains around which countries and producers could do this when and how.

To better understand the broader context of these uncertainties two additional foresight techniques are frequently employed: scenarios and technology roadmaps.

To apply these to our case we first need to determine where we are now in 2012 – where we seem to be heading and whether this can or should be altered, accelerated in some manner through policy actions.

Foresight Scenarios

Scenarios explicitly build upon identified key uncertainties to develop future oriented situational narrative visions and glimpses of plausible future operating environments that can reveal business challenges as well as opportunities flowing from the resolution of the identified uncertainties thereby enabling anticipatory actions in advance of one’s competition.

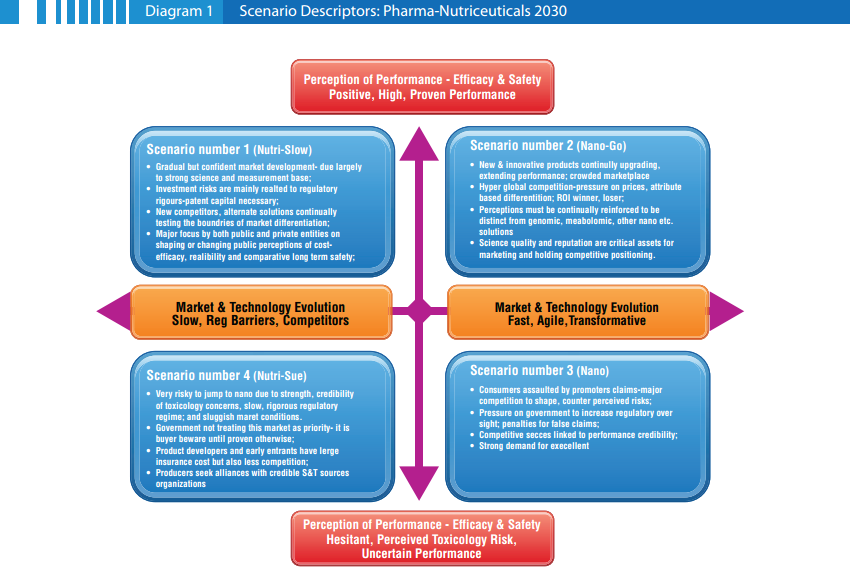

For example in the area of future nutra-pharmaceutical applications, here are four representative scenarios that are derived from the dual uncertainties of Science and Technology (S&T) rate of progress, and the pace and performance results of regulatory oversight: what is most apparent is that regardless of whether the performance is uncertain or high, as soon as the dynamic for S&T progress shifts into fast – the result moves into the nano driven zonea clear alert for technological disruption watchers. So what messages are the foresight scenarios conveying?

• The current market – 2012 – for conventional pharma-nutraceuticals is projected to remain sluggish but could soon be highly vulnerable if (as expected by leading scientists), nanoscale design and production advances enable producers in other countries or markets to shift into what is described as fast and transformative a situation that would create a new base for competition;

• There are understandable uncertainties associated with R&D, regulatory approval which will have to be closely monitored because if the new nano techniques are able to obtain approval then current production platforms will become as obsolete as floppy disks competing against flash drives.

• While timelines are imprecise in foresight, it is clear that key change factors – as represented by the scenario drivers and uncertainties – are going to be influencing the next business cycles of pharma-nutraceuticals – so now it is time to apply technology road mapping and then competitive intelligence techniques.

Technology Roadmaps

More specific to the needs of most business enterprises than scenarios, (which are typically initiated by governments) technology roadmaps are employed to further reduce uncertainty; first by being managed by industry, and second, by having more near-term and specific decision time lines for investment – i.e. What specific investments will be required and when (e.g. new R&D; equipment, training and skills development, emerging market research) to acquire the needed agile capacity to realize the opportunities and to reach the business destination before others.

The TCOS Framework pioneered by the RAND corporation, encapsulates these concerns, where uncertainties associated with Technological, Commercial, Organizational and Social factors must be overcome before an invention will likely become a successful innovation:

The TCOS uncertainties can be regarded as a series of hurdles, but they can also be regarded as potential sources of competitive advantage/ disadvantage – i.e. competencies in one area compensate for deficiencies in another. So now let’s look at how this example might apply to Malaysia – a country where conventional pharma-nutraceuticals are doing quite well but without much awareness or preparedness at the firm level for disruptive change on the scale that a rapid shift into nano design and production would imply.

Table 3, (developed by one of the authors for a Canadian foresight exercise in 2007) shows, for example, how a generic foresight roadmap might comparatively position – in terms of relative risks (technical, market and policy) – different candidate emerging technologies that involve nanotechnology applied to food and water applications.

We shall illustrate how intelligence and business analytics can be employed to more precisely and quantitatively determine how to choose between the candidates that make it past the initial uncertainty filter of the roadmap which is derived from expert opinion and tendsto be qualitative

Subsequently by 2010 we can see that nano-nutraceuticals are already being actively pursued for risk reduction and commercial opportunities:

Although technology foresight is showing that several pharma-nutraceuticals have already been commercialized, risk nevertheless remains, mainly because the regulatory environment has not yet fully rendered its judgements. Here is an example of regulatory research that continues to impact the long term horizons for nano-nutraceuticals: The conclusion of the technology roadmaps application is that:

• The TCOS framework suggests positive potential from the new technological opportunities;

• Further R&D will be required, especially in terms of the regulatory hurdles;

• To succeed – or at least to be early entrants into the emerging new nano-based nutra-ceutical design and production platforms will require excellent scientific capabilities and equipment that aspiring firms must plan and recruit for in advance if they want to be competitive.

We leave the foresight section with a clearer understanding of potential emerging scenarios in nutra-pharmaceuticals and the recognition of the need to get Malaysian companies moving forward faster in transformative technologies in this area. In particular, a program is desired to get Malaysian companies developing nano based nutra-pharmaceutical products. Through the road-mapping exercise we also have a sense as to what areas of research and product development will be most important to work on at least from a 10 to 20 year timeline.

A final point important for all readers is to understand the method by which these conclusions were reached. Scenarios, roadmaps and scans are all externally focused. That is it relies on information provided by experts generally outside our organization. A scenario exercise typically brings together dozens of industry participants (company executives, academics, association executives and so forth) not just from our country but from around the world. In a Canadian scenario workshop on Oceans Technology, over 100 people participated, coming from organizations representing 75% of all the industry. In this way information from all portions of the industry and not just government can be integrated in making sound policy decisions. As well, by having this broad a representation of the industry meet and work towards a shared vision, there is better chance of the industry accepting the industrial policy developed and its associated programs. Having industry help in the development of industrial policy in this manner is logical as if they have a role in forming the policy there should be less reluctance for them to accept the program policy and instruments. This leads to a reduction in program uptake uncertainty.

Intelligence – Further Reducing Uncertainty

The Strategic and Competitive Intelligence Professionals Society (SCIP) defines competitive intelligence (CI) as:

“the process of monitoring the competitive environment and analyzing the findings in the context of internal issues, for the purpose of decision support. CI enables senior managers in companies of all sizes to make more informed decisions about everything from marketing, R&D, and investing tactics to long-term business strategies.”

(http://www.scip.org)

The Competitive Intelligence NING, an online community of intelligence professionals further defines it as:

“the interpretation of signals from the environment for an organization’s decision makers to understand and anticipate industry change.””

(http://competitiveintelligence.ning.com/)

At the heart of competitive intelligence is decreasing environmental uncertainty in the short to medium term by integrating information from various sources and applying appropriate analytical techniques. How does this work for our nutra-pharmaceutical example? There are three shorter term external environmental uncertainties that need to be addressed to create an industrial assistance program that is properly targeted.

1) Program uptake uncertainty: What will it take to get the corporate decision makers to invest in nano-neutri-pharmaceutical research? What levers can we use in an industrial program to cause the companies to shift R&D?

2) Domestic capacity uncertainty: What specifically are we going to have to support? What stage of development are our companies and infrastructure in?

3) Time line induced market uncertainty – While foresight did help to decrease the timeline based uncertainty, nevertheless foresight is not designed for prediction. We have four plausible scenarios and want to get increased certainty on, for example, how fast and transformative science currently is. 10-20 year scenarios and roadmaps provide superb indicative information for program design but we will have to get a better sense of what is likely going to happen over the next 5 years, a timeline that industry is more likely to respond to.

These three areas of uncertainty now form the core of an intelligence program. An intelligence program consists of several key intelligence topics (KITS) that collectively are required to make appropriate recommendations. KITS are external environmentally focused, so similar to foresight, it is very much an outside-in approach. Let’s look at two of these KITS.

The industry – the next five years: The first project seeks to gain greater certainty about the drivers of science and technology. How fast is it currently moving? Where is it likely to be in the next 5 years? Where is the industry going? An intelligence practitioner would break this down into a series of intelligence questions or needs and apply appropriate collection and analysis techniques to each. I will highlight two that could be used for this KIT – Time-lining and Back-casting.

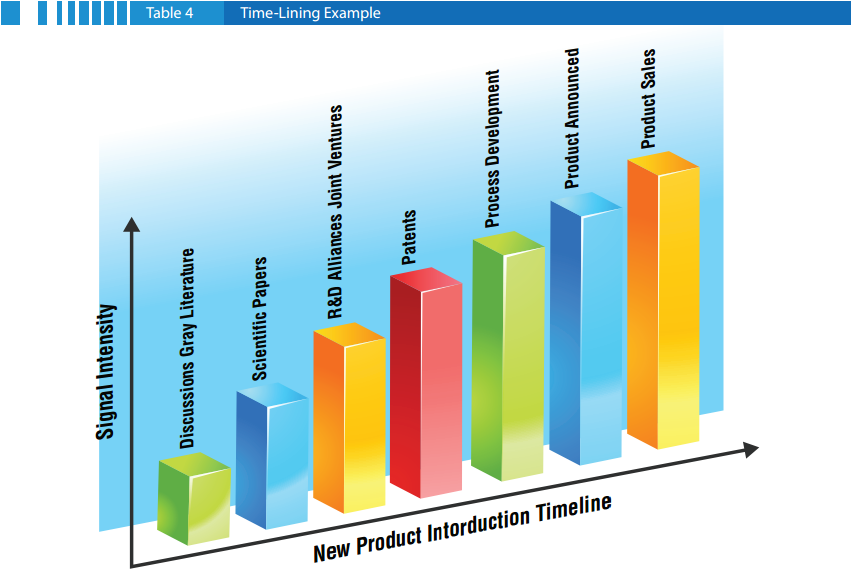

Time-lining: Intelligence realized a long time ago that there were logical sequences to any major shift in a marketplace. For example, long before a new technology hits the market there had to have been manufacturing activity, before that testing, before that research and so forth. Each of these sequenced steps leaves information that those interested can view. For example research activities are accompanied with patents and sometimes poster sessions at conferences. Table 4 provides an example of a science based timeline.

It is no wonder that several companies have told employees that when they see someone new at a trade show to let management know. The new player could be a potential customer, competitor, supplier etc learning about the industry. It’s an early sign on the timeline. Similarly techniques such as science mapping have been developed to look at what research communities are coming together to better project research direction. Again, an early signal in the timeline. While projecting 10 years is very difficult, time-lining makes things a little more certain by looking at what activities have already been done. The idea then is to identify what is currently happening in the industry at a global level and place it on the timeline. The information is taken from secondary sources such as magazines and various online databases but is also more commonly found by attending industry events. Event intelligence is a growing discipline within intelligence and involves organizing for collection at conferences, tradeshows, workshops and the like to collect this kind of information.

By use of event intelligence it should be relatively straightforward to identify how fast and transformative science currently is and for example, where various companies are at on the timeline. Logically, if nano enabled pharmaceutical is to be commercialized, there has to have been many other activities that precede it. Our job in intelligence is to look at what currently has been done and thereby determine likely directions.

Back-casting: Another version of this technique is back-casting. This works in the reverse of time-lining and asks what activities must have preceded the event we are concerned about. For example, in a recent exercise that the authors were part of in food safety, “fast transformative science and technology by 2020” meant that everyone would have hand held food scanners that were DNA programmed. If that was to happen by 2020, then in a back cast, these devices would need to have been in pilot testing stage by 2015, since it would take at least 5 years to get volumes to the levels where consumers could afford to buy them. For this to be invented by 2015, food scientists estimated that by 2013 at the latest you would have to have DNA coding for a variety of allergens and foodstuffs(which does exist) and a bio-informatics infrastructure that could hold this data (which we currently do not have). For this to occur (the bio-informatics infrastructure) to occur by 2013 would require a research and training capacity in Universities for developing this by 2011 and that had not yet happened. Conclusion – the 2020 scenario had a low likelihood of happening as by 2015 – which were only 3 years away from when the back casting exercise was done – a product would have to be developed which could not happen given the current state of science and technology. One day it will happen, but based on the back casting not by 2020. The conclusion was that the speed and nature of transformative technology based on intelligence gathered and developed today would not be as fast as suggested in that scenario. These two techniques, – time-lining and back-casting help to reduce uncertainty.

Program uptake uncertainty: Let’s assume that time-lining and back-casting have validated the type of research and development that the program will support. Also assume that through techniques such as sentiment analysis (to be described in the next section) and resource gap analysis we have validated that there is capacity and desire in our country to support the program. With domestic capacity certainty and now reduced time line induced market uncertainty it is now time to reduce participant uptake uncertainty – so let’s get them making the decisions that support the program outcome – invest in nano based nutra pharmaceutical research and development. Put another way, how do we change their minds? Here again is where intelligence becomes key, the technique is called profiling and involves putting together detailed psychological based assessments of the targets for the program. The idea in profiling is to identify all the questions that must be answered so that we can project likelihood of a positive decision outcome. The difficulty in putting together a profile is threefold:

1. Who do we profile: You can’t do detailed profiles on every company in your industry, thus you need to decide which ones are most important to profile. This requires in-depth industry understanding. At a minimum you profile those companies that you know could, if properly motivated, develop the appropriate technology within the program time period. But you need to know your industry participants well.

2. What specifically do we need to know? Given that the objective of the profile is to design appropriate policy instruments that would lead to targeted investments, we would need to be able to gather sufficient data so that we can project the likelihood of the organization investing in nano based nutra pharmaceutical research at a minimum these profiles would need to have items such as how they make R&D and product decisions, the factors that are most important, their targeted returns on investment, risk taking portfolio etc. How will they react to loan guarantee versus tax credit versus straight grants?

3. Where are we going to find this information? Intelligence plans put a lot of emphasis into the collection side; where to find the information and how to collect it. Fortunately for a project like this most of the information required to profile the companies should be readily available to the government. For example, they may have already applied for programs and a check into the program files and discussions with program officers who managed the program would help. Further, as part of the scenario exercise described above for Malaysia, key industry participants should have been invited. While at the event you will have heard from them where they are at in their research, how they make decisions, what they want from government and so forth. Integration of information already provided to the government through meetings, workshops, program applications and consultations from key companies should be readily available to use for development of these profiles. If not, the information will have to be collected by directly interviewing these participants.

By developing profiles on the key companies, designing the appropriate program then should be relatively straightforward as the concept would be; develop the program that you know (based on in-depth company understanding) will cause them to make the investment decisions needed by your industrial policy.

It is unwise to develop industry assistance programs without this understanding and government cannot simply assume that if they put out a loan guarantee program or tax credit program no matter how generous they perceive it to be, that industry will similarly find it desirable. In the next section, business analytics will be used to further refine this element of program design.

The intelligence examples provided above provide a snapshot into how intelligence techniques can be applied to reduce industrial policy risks and increase the probability of program success. The examples have been used to understand the likely direction of the technology environment and the behavioural profiles of the targeted companies. However it can also be used to understand customers, competitors, other governments, suppliers and other elements of the environment that are important to understand for industrial policy program success.

Business Analytics

Business analytics is currently in vogue as a buzz word for the use of data to inform decision making in organizations. It its current incarnation, it is tied closely to the use of data mining techniques to analyze what some refer to as “big data”—large complex data sets that might provide insights if mined properly. In reality, business analytics has been used in organizations for many years, and hundreds of different techniques are available—all focused on optimizing one or more organizational outcomes.

How does business analytics play into the scenario discussed above? If a policy initiative is to encourage businesses to invest in nano-nutra pharmaceuticals, a variety of analytic techniques can be used to anticipate the actual take-up of the provisions of the policy. We’ll discuss two relatively simple techniques to illustrate the integration of foresight, competitive intelligence and business analytics within the context of national policies.

Two aspects deserve consideration: estimation of the expected value of the policy and evaluation of the likelihood that participants who are expected to avail themselves of the policy will behave in ways that will provide the expected value.

Recall from the intelligence section, company profies were used as a basis to determine what types of programs would cause the intended behaviour. In this section we refie this and further reduce program uncertainty but use of econometric models. These models will be applied to understand consumer behaviour (the eventual customers of nano based nutra pharmaceuticals) and the likelihood of companies accepting our policy instruments to encourage appropriate nano based nutra pharmaceutical research.

Econometric models are typically used to estimate the social and economic benefits to be derived from a policy. But the models rely on data gathered from stakeholders related to the policy environment. One relatively new approach to gather data is “sentiment analysis”. This approach, based on analysis of qualitative information appearing on millions of websites and blogs from the intended audience helps to identify opinions related to the outcomes being promoted by the policy. In addition to forecasting techniques such as scenario planning and roadmaps, sentiment analysis can provide guidance as to the attitudes prevalent in a particular population. It can be used for example, to predict the expected take up of provisions of the policy. Assuming that expected policy outcomes include the launching of businesses developing nano based nutra-pharmaceutical products, analysis of consumer sentiment can provide clues of potential customer acceptance.

In addition, government policy makers can anticipate how the businesses they expect to participate in the initiative will make their own decisions using business analytics. For example, if banks are to honour loan guarantees, they will evaluate the risk associated with the loan. Loan risk algorithms have been developed by many banks that can be used by the policy makers to simulate banker behaviour related to the policy. With this information in hand, we can go one step further and simulate the decision process used by businesses who might take advantage of the loan guarantees. Businesses typically invest in new products in order to turn a profit.

Investment decisions can be quantified through the use of a variety of analytic models, one being the “net present value” calculation. This approach discounts future expected cash flows of an initial investment to estimate potential returns. The calculation is as follows: $I –[$R /(1+i ) t] Where $I= initial investment, $R=expected returns (cash flow) from sales of the product, i=expected interest rate during the time period, and t=# of compounding period. As a practical example, supposed the business would need to invest $400,000, but, based on a loan guarantee from the government, banks would advance a loan for half of that amount to be paid back at a preferential interest rate at some point in the future. The company estimates cash flows for the first 3 years after full production of $100,000, $150,000 and $250,000.

Assuming a 6% interest rate (added to the principal investment amount), the NPV works out to: $469,931-$437,743 (discounted cash flow) for a total of -$32,188. With the loan guaranteed by government, assume the interest rate charged on the loan is reduced to 3%, the cost of the loan added to the $400,000 investment is now $432,358 leading to an NPV of +$37,573. The decision rule for NPV calculations is to invest in projects with a positive cash flow (realizing that the decision maker might have a number of projects with positive cash flow).

Ultimately, using the formula to simulate a business person’s decision model can help policy makers to better predict uptake and more accurately define the parameters of a policy. The data used to establish sensitivities around this model will have come from the intelligence profiles developed earlier.

Sentiment analysis can also be used as a long range scanning tool to anticipate when changes to the policy framework might be needed. What does this approach do exactly? Tools such as IBM-Cognos Consumer Insight (CCI) will gather millions of comments (facts and/or opinions) from websites, blogs and tweets. Using a combination of Natural Language Processing and Artificial Intelligence, CCI will extract combinations of words from the various sites and “score” the comments so to speak as positive or negative. The program can also create clusters of opinions based on criteria established by the analyst. Therefore, CCI can cluster and score opinions by the banking, business and consumer sectors providing insight into the evolving sentiment in these 3 groups important to the policy.

Business analytics therefore has supported the intelligence developed earlier and served to further reduce uncertainty by providing the ability to process millions of pieces of information contained in blogs and other discussion sites on the net and by providing tools to model likely investor behaviour based on sophisticated algorithms.

Tracking Policy Effectiveness: The Integrated Policy Dashboard

Up to this point, forecasting, intelligence and business analytics have been shown as key tools useful for reducing industrial policy design uncertainty and increasing the probability of its success. But the use of these tools does not end with the development and implementation of the policy. These tools can also be used to create an “integrated policy dashboard”. Such a dashboard can help reduce uncertainty during the implementation period by providing up-to-the-minute information on the outcomes of the policy. But forward-looking information can also be integrated…i.e., the long range scanning information discussed in the previous section.

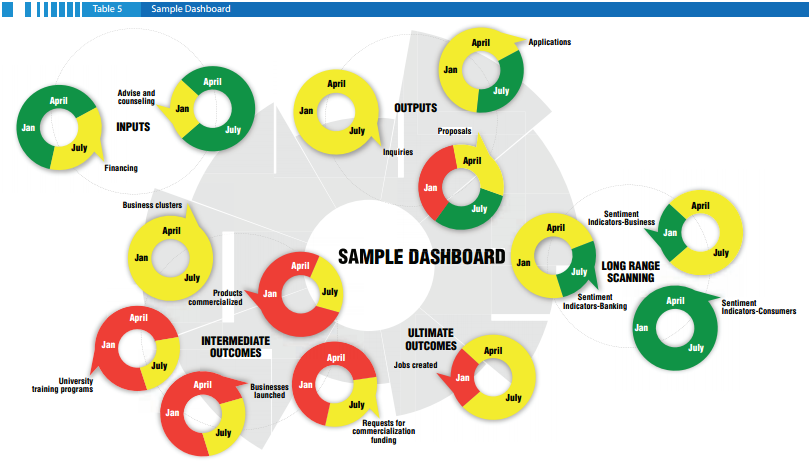

What is a dashboard and how do you develop it? A dashboard is a display of key performance indicators that help institutions steer their activities towards their declared strategic outcomes. To develop a dashboard, we first clarify objectives, define related measures, and then define what you do with the measures.

Many different structures are used for dashboards. The model depicted in table 5 defines inputs, outputs, intermediate and ultimate outcomes: a well-known planning structure in governments. One of the benefits of the dashboard is to alert policy makers about performance against objectives, but also to identify the factors that influence those objectives. The colour scheme in is based on variance analysis (actual versus target). If actual results are on (or better than) target, the dashboard returns a green. Yellow normally indicates 10-15% off target, and red is returned with actual results are off by more than 15%.

Obviously, any number of different structures can be used for a dashboard; table 5is a simple example to illustrate the use of such a tool for tracking policy effectiveness. An important point to realize about the dashboard is that it too provides an occasion to use business analytics tools to better understand policy performance.

In this case, we would be using causal models to define the drivers of outcomes that we seek. We can see for example, that a time lag exists between “advice and counselling” (referring to the number of people who have sought advice on the program) and applications. One period after advice and counselling goes from yellow to green (meaning that we are on target), the number of applications goes green. This might be strictly coincidence, but depending on the type of data available, the relationship can be tested through regression modelling or a myriad of non-parametric techniques. In addition to the business analytic elements of this dashboard which arises from analysing a myriad of data contained inside the government and on the internet (for continued sentiment analysis), we could add information obtained on a continual basis from the intelligence effort. For example, when our employees attend industry events (e.g. tradeshows, conferences and workshops) they would continue to update the profiles on the companies, the technology roadmap and the technology driver analysis described in the intelligence section.

For example, each year Malaysia sends a delegation that includes government officers to the Bio International Convention in the United States. This is the largest gathering of biotechnology practitioners in the world and includes some 50,000 delegates from around the world. 125+ educational sessions, over 1800 exhibitor booths, dozens of government booths, and various presentations. An event such as this one provides opportunity to find out what other governments are doing in their nano based nutra pharmaceutical programs, where the industry is at in terms of the roadmap and also how fast science and technology is evolving. It provides information on where the industry is at today and what research is being done today.

By integrating information from events such as this within the context of a dashboard it becomes possible to identify if the initial assumptions made in the development of the industrial program in terms of type of technology needed, where the industry is going, what other governments are doing and so forth is still correct. Changes noted either through event mining, sentiment analysis and other such techniques then provide the early warning needed to determine if the industrial policy is on track or whether it needs to be changed. For example if the speed of transformative science and technology appears to be speeding up at the global level, additional funds may need to be allocated to speed up development in Malaysia.

The program dashboard can therefore be used to reduce timeline induced market uncertainty by integrating real-time information on market developments obtained both from external sources (e.g. events) and internal sources. Program uptake uncertainty is also monitored on a daily basis to identify if program targets are being realized.

Conclusion

Industrial policy is fraught with uncertainty due its reliance on external environmental elements for its success. Foresight, intelligence and business analytics taken together provide the toolkit to better understand this uncertainty and can help lead to more successful industrial policy. This is especially important in today’s industrial environment where activities arising outside your country can impact technology directions, market attractiveness and so forth. Foresight and Intelligence with their external environment focus provide the tools to among other things understand the direction markets are going in, profile your local industry to determine what policy instruments can work on them, and better understand how technology is going to evolve. Signals picked up today through an externally focused intelligence effort can be used to confirm conclusions reached in longer term foresight initiatives such as scenarios, roadmaps and scans thereby providing the information needed to establish the longer term oriented industrial policy needed in science and technology related industries.

As has been shown in this article, you need to understand the environment of tomorrow to develop the industrial policy of today as the products and services that domestic companies will launch as a result of the policy have to match the needs and realities of the market at the time of product/service launch. Not the needs and realities at the time of industrial program launch. In many cases the different between these two (product/service launch vs. industrial program launch) can be ten or more years.

This article has also shown how through foresight exercises, intelligence and business analytics it is possible to learn enough about the targets of the intended industrial policy (e.g. the companies that are to use the loans, or tax credits etc.) so that the right level of incentives can be set to encourage the companies to commit to the policy direction.

Finally, dashboards which use a mix of internally generated information arising from company program requests and interactions with the department coupled with externally gathered information such as from blogs, wikkies and conferences can be used to identify if the program is on target long before problems can arise. These sources integrated into a dash board so that in real time the Department or agency can identify

1) If the projected industry direction (e.g. Market demand, speed of technology development) is changing – thereby reducing timeline induced market uncertainty;

2) How the intended targets (local companies) are using the program, what issues they are having with it, questions they are asking etc-thereby reducing program uptake uncertainty.

These techniques and the kind of dashboard being suggested in this article give decision makers the information they need to better align industrial programs and policies with the realities of the local (Malaysian), regional (Asian) and international environment.