by | Chor Pharn Lee, Principal Strategist, Centre for Strategic Futures, Strategy Group

Chor Pharn Lee is a Principal Strategist at the Centre for Strategic Futures. In this role, Chor focuses on developing the centre’s strategy and delivering results aligned to the centre’s national objectives.

Chor has been with the centre, a think tank that pursues long-term futures research and builds foresight capabilities across the public service since 2016.

Chor spent nearly 25 years as a strategist and an engineer for a number of Singapore’s trade agencies. Prior to his current role, Chor served as the Deputy Director at Singapore’s Ministry of Trade and Industry. Before joining the ministry, Chor was the deputy director at Infocomm Development Authority specializing in communication and marketing.

Currently based in Singapore, Chor holds a master’s degree in Electrical and Electronics Engineering from the Cornell University, America and an MBA from the Nanyang Business School, Singapore.

I gave the keynote a few weeks back at the Asia Pacific Futures Network, held in Bangkok. The theme was ASEAN 2030, and I wanted to get the audience to think about decades differently, first starting with the past and then looking into the future. Like warmup exercises.

Below are my raw scribbles, lightly edited.

If you stood at the dawn of 1980, your prominent belief of the WAY the world is would be informed by the oil crisis, that you should own real assets, especially energy assets, and American businesses are number one. But if you were contrarian and owned zero energy and held on to those assets, you would have been rewarded handsomely because the top companies of 1990 were Japanese.

Standing at the dawn of 1990 looking out a decade, you may have believed that you should start learning Japanese and move to Tokyo, Japanese management techniques like Kaizen would ensure that Japan would take over the world. But if you were contrarian and underweighted Japan, you would have done handsomely because the top companies of 2000 were not Japanese but a mixture of “old economy” versus “new economy” stocks in media, telecoms and technology. But if you ignored the “sticky eyeballs” hype, it would have paid off for you come 2010.

Standing at the dawn of 2010, you would breathlessly see China as the rising giant, with an insatiable thirst for commodities driving a super-cycle of peak oil, peak copper etc. The top companies were involved in digging things out of the ground. And if you said no… well, you see the pattern right? Because by 2019, the top companies are technology platforms and not commodities extractors.

So, today on 17 Sept 2019 with only a few months to go till 2020, what would you be thinking?

Understand the present.

This little exercise is humility inducing. It is not easy to sense the future. The tendency is to project the recent past into the future and not pay attention to the subtle, hidden macro conditions that are evolving just beneath the surface. We need to do better to know the present. This means reading emerging strategic issues in near real-time, and looking out for phase changes. During a phase change, certain properties of the medium change, often discontinuously, as a result of an external condition. Think of water as a solid, liquid and gas.

I will talk a bit more about this at the “how to” section towards the end.

Let’s go back to standing at the edge of 2020 today, and the answer you might be thinking of is “tech platforms”. Because of their near monopoly status, tech platforms deliver the growth and productivity and frankly most of the excitement in the world today.

Going by geographic focus, you might also think of “America” as a disproportionate number of them are American. And all this is sensible. But you might pause, hold back and think of your experience since 1980 and ask how might I approach this differently?

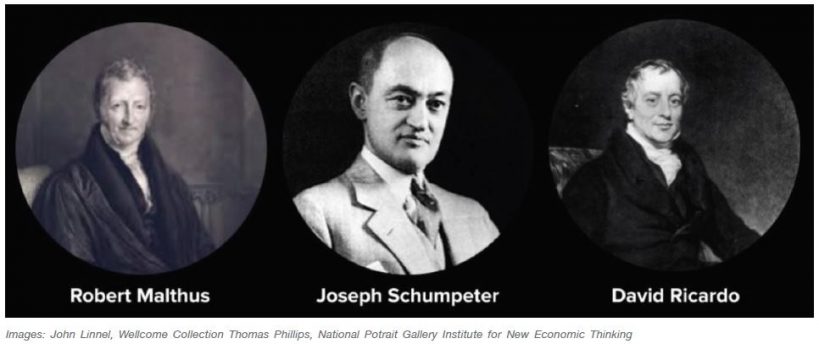

Three dead economists.

Here’s where three dead economists might show us a way to think about the changing macro conditions beneath the surface, and emerging strategic issues that point to a phase change.

Ricardian expansions, named after David Ricardo and the theory of comparative advantage in international trade. This is usually expansion into new territories like China.

Schumpeterian expansions, named after Joseph Schumpeter who popularised the term “creative destruction”. This is typically driven by new technologies – railways, smartphones, the internet, AI – that typically lead to progress for humanity.

Malthusian contractions, named after Robert Malthus who worried about food shortages with a rising population.

The consensus out there is Schumpeterian. It is a brave new world dominated by more “software eating the world” – into finance, into healthcare, into energy, as robots and machine learning eliminate mindless work and we shift away from fossil fuel dependence.

But we might want to pay heed to growing techlash.

Techlash from the many scandals that firms have misused and mishandled personal data, firms that misuse their monopolistic positions to “eat the ecosystem” and throttle startups. For example, Amazon has such high monopoly power that when the French government imposed a 3% digital tax on Amazon in 2019, they passed on the entire tax to small and medium French businesses using the platform!

European and American regulators are already considering a clamp down on these tech giants and break up their market power.

Decade long big trends might be like very big dogs – they seldom live past their first decade. The historical precedents would suggest that the next decade long trend may be Malthusian – not enough for everybody – or Ricardian – new territories?

The obvious candidates for Ricardian expansions come under a cloud when we consider the collision of demographics, automation and climate change. For example, many face significant challenges ahead. Demographic bulges might not be demographic dividends due to poor human capital investment and inability to create jobs. And fewer are well placed to handle the coming wave of automation or climate change. Capetown was voted the best city in 2015, and this year experienced a harrowing Day Zero [defined when most of the city’s taps will be switched off – literally.] This is not an anomaly. The south Indian city of Chennai also had its Day Zero.

How about other candidates like Central Asia in China’s Belt and Road Initiative? How about the 3 billion unbanked that Facebook’s Libra is targeting?

How about the far North when climate change opens up new territories for trade and energy?

Day Zero and the far North segue into Malthusian contractions, where climate change will be a main driver of high temperatures, food and water stresses in many geographies.

The physical risks of climate change are well known, but transition risks are not. Transition risks are financial risks which can result from the process of adjustment towards a lower-carbon economy prompted by changes in climate policy, technology or market sentiment.

This can sound very bloodless

But I think we should pay attention especially to sentiment because if physical risks pile up, disasters will be so frequent that market solutions will be insufficient. Politicians will intervene to distribute costs where policy and market fail. After the recent EU elections, the Green Parties are now the kingmakers and Europe may be on the verge of its own Green New Deal.

So there, we have three different lenses to talk about the next decade.

This little exercise is not meant as an investment guide! I am trying to point out how we humans anchor easily to immediate events like prices, but we are lousy at reappraising fundamentals and changing our views.

Let me change pace a bit and focus on the “how-to”s.

How do you see the future in the present?

Outliers. Find this 17% of the population who see the world differently before they know society condemns them as deviant. How do you find them? How do you connect with them?

In place of conventional (asset-heavy) approaches, an asset-light approach focuses on befriending “strange attractors” to pull interesting thinkers into your orbit. Strange attractors are generally not found on the circuit, but in “dark forests”. Once we get inside these channels, we can access new, unconventional thinking and opportunities as it emerges.

Dark Forests is borrowed from Liu Cixin’s sci-fi trilogy The Three Body Problem. The universe is full of predators, so forms of life that exist keep their silence. The Dark Forest theory of the Internet describes how, in response to the ads, tracking, trolling, hype and other predatory behaviours etc. interesting conversations are moving to private channels like newsletters, podcasts, slack channels.

Small roundtables. Unstructured. Clever, thoughtful, unusual individuals. A hard topic and let them bounce off ideas in a relaxed environment. We run a foresight conference every other year in this format to get ideas that one would not normally come across.

Don’t be a computer. What are humans good for? Spotting outliers, connecting patterns and so on. Don’t put them in environments that are better for AI and Machine Learning. Art, not just classical art but also the disciplines to create art, help you see novel connections.

Generations. Use trans-generational groups to help find new solutions, combining the practical wisdom of age with the inspiration and ideas of youth.

How do I do futures?

Exaptive. This is a process in which a feature acquires a function that was not acquired through natural selection. This function is repurposed for novel use. Like feathers. The earliest feathers belonged to dinosaurs not capable of flight. They must have first evolved for something else. Researchers speculate early feathers may have been used for attracting mates or keeping warm. The idea is to prepare things in advance so people will change.

Here’s an example. Think about the gorilla and basketball exercise. People are so focused on the ball passing that they mentally block out a man in a gorilla suit walking past. But if you showed them a nature documentary prior, the number of people who spot the gorilla goes up. Futures is that nature documentary so we prime people to spot that man in a gorilla suit.

Bad news. People don’t buy utopian novels or fancy cosy visions. That is just our biological imperative. Brains pay attention to failure, not to success. Evolutionarily speaking, avoiding failure equals success. Don’t fight against biology. Dystopias help focus attention, and then present counterfactuals [relating to what has not happened or is not the case] which sets the brains in the room up to focus on doing something different today.