by | Mohd Hasan Mohd Saaid, hasan@might.org.my | Ahmad Razif Mohamad, razif@might.org.my

The shipping industry is among the most important activity in human development. Historically, it started from people who just wanted to explore the seas and venture into the unknown. Then, as human gets better at building bigger and better ships, trading goods and services became a booming activity, creating many economic pursuits and specialisation from each country. Currently, over 90 percent of world trade—the import and export of goods on the scale necessary worldwide—is carried by the international shipping industry. The growing efficiency of shipping as a mode of transport and increased economic liberalisation, further increase the prospects for the industry’s continous strong growth. With an industry that old and reliable, we would not expect there to be many new ways to disrupt it. However, technology has helped to disrupt most industries and the shipbuilding and ship repair industry is no different.

Keypoints from Marine Industry 2030

Combining public and proprietary information as the input into a scenario development methodology, Global Marine Trends 2030 (GMT2030) envisions three possible future maritime scenarios; namely Status Quo, Global Commons and Competing Nations. During the session, the main discussion was the interaction between people, economies, and natural resources that will shape the future of maritime.

These three scenarios bring about different impacts on individual marine sectors. The commercial sector is influenced by all economy, people and natural resources, while the energy sector is influenced by economy and natural resources only. It is discovered that economic power is the primary driver in the naval sector.

In all cases, it is projected that the marine industry will grow and play a positive role in international seaborne trade as well as overall expansion of the global economy. Emerging technologies in the shipbuilding and ship repair industry brings significant value and impact on the commercial shipping, naval, and ocean space sectors. Identifying and applying these technologies will benefit policy and decision makers, helping them recognise risks and opportunities as well as making the right investment decision at the most opportune time.

Technology Trends Toward Industry 4.0

In Industry 4.0, technology plays a crucial role in ensuring the maritime industry can optimise opportunities and reduce risks. While in the manufacturing industry, the term ‘fourth industrial revolution’ or Industry 4.0 describes how ‘smart devices’ will replace the role of humans for the management, optimisation and control of machinery. Although technology has always benefit the industry players, many do not fully understand its potential to have an immense impact. This explains why some industry players are still behind in implementation, despite the rapid growth of Industry 4.0 technology. UK’s latest Industrial Digital Review highlighted in general, how digital maturity is low in shipbuilding and ship repair industry.

The local SBSR industry is undergoing a dramatic wave of change driven by the evolving patterns and increasing volumes of seaborne trade. Growing demands to support offshore activities such as in the exploration and production of oil and gas (O&G) also contributes to the changing landscape of maritime.

Shipbuilding and ship repair technology advancements, the enhancement of yard capacity/capability and availability of financing have combined to enable the construction of larger and more sophisticated merchant ships. The creation of this large capacity ships have also spurred investment in ports, logistics sector, and various trade infrastructures and facilities to meet the insatiable global trade demand. This will continue to influence and shape the landscape of the SBSR industry.

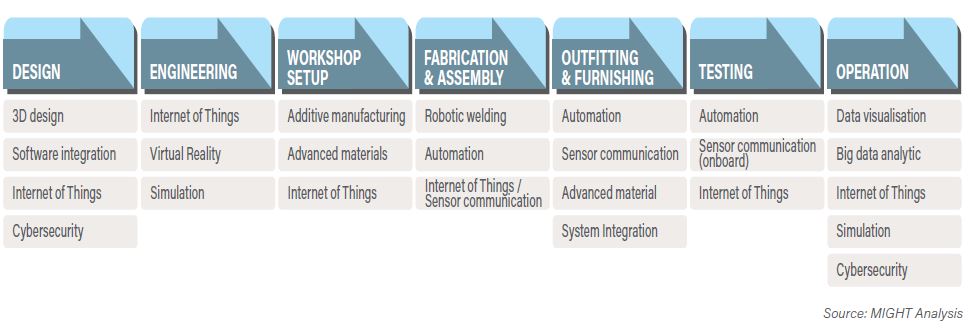

The following trends described here are sub-categories of the major application in SBSR value chain industry which will have a telling influence on shipowners, shipyards, shipping industry stakeholders and seaborne transport and services in general. These technology trends can be grouped into following theme:

♦♦ Productivity time-to-market of complex shipbuilding programmes

♦♦ Innovation in term of connected ship and the connected fleet

♦♦ Reduce costs, lead time and quality issues in design, manufacturing and the supply chain

♦♦ Sustainable growth and business effectiveness in operations

Riding high on R&D activities, the shipping industry has developed some potentially revolutionary technologies. Mentioned below are several important technologies which might help to change the future of shipbuilding.

1. Big Data Analytics

Big data analytics is a term used to describe the process of analysing this big data to uncover hidden patterns, unknown correlations, ambiguities, market trends and other useful information. The huge amount of data

produced today is difficult to be processed through traditional data techniques and applications. The scale of the challenge is well illustrated by the current estimate of a 4,300 percent increase in annual data generation by 2020 and the figure is projected to increase even further by 2030.

The management and analysis of big data will become increasingly important and it is predicted to create a major impact on the marine world in the future, driven forward by the demand for information and the need to handle the variety of new data sources that are likely to appear.

However, big data may also face other factors that can threaten its adoption, such as the lack of the necessary data analysis skills required to exploit big data. Most definitions of big data include the three Vs (data of high volume, velocity, and variety) for enhanced insight and decision making. Some organisations have also added a fourth V that represents veracity, which concerns the accuracy and reliability of data.

With these definitions, a greater volume of data will not necessary mean a better output. The more important thing is analysing poor quality data can lead to ambiguous and misleading information, potentially resulting in poor decisions. In the future, new technologies may emerge that can improve big data analytics. Among these will be some of the so-called ‘smart machine’ technologies and computing systems that process data in a manner similar to the human brain.

What we are seeing in the market:

♦♦ BAE Systems Australia plans to transform Australia’s shipbuilding industry to a digital shipyard in Adelaide.

♦♦ With real-time data collection and exchange across vessels, ports, cargo and land logistics, the digital ship enables Hyundai Heavy Industries to create new customer services and revenue streams across the lifecycle of ships and journeys, removing traditional barriers between different elements of a ship’s operation.

♦♦ Inmarsat, a global mobile satellite operator has launched a new service in partnership with Samsung Heavy Industries (SHI), called Smart Ship by SHI. Designed to allow commercial ship owners to enhance efficiency by harvesting data from hullmonitors and equipment sensors onboard in real-time, via Inmarsat’s dedicated bandwidth for Certified Application Providers (CAPs).

2. Sensors

The term ‘sensor’ covers the wide range of devices used to measure the physical environment in which a vessel may be operating, the characteristics and state of the vessel, as well as the physiological and mental condition of the ship crew. Sensor technologies are developing rapidly to meet the ever-growing consumers demand for data and information. As an example, The Internet of Things (IoT) allows real-time monitoring, control of systems and also address the need of ever-increasing capabilities to measure the ocean environment, including biological, acoustic and electromagnetic characteristics.

Sensors adoption is driven by;

♦♦ Advances in miniaturisation coupled with low-power generation technology

♦♦ Moving the intelligence into sensors with closer integration of sensors, actuators and processing power

♦♦ Lower production costs to meet the demands of wearable technologies;

♦♦ Standardisation, in particular at the junction between device and chip architecture;

♦♦ The low-power transmission of data and energy harvesting; and the management and integration of sensor types such as semiconductors and Micro- Electrical-Mechanical-Systems (MEMS). Sensors act as the enabler for technology developments in improving the interaction between people and machines. Cognitive systems will not necessarily be programmed to anticipate every possible answer or action needed to perform a function or set of task; instead it will be designed to feed the learning loop in an exponential manner through artificial intelligence (AI) and machine-learning algorithms. The widespread use of sensors are already being introduced in areas such as automotive and scientific applications and soon will expand into the marine/maritime domain, enabling better situational awareness and vessel management.

What we are seeing in the market:

♦♦ Navantia Australia proposed F-5000 frigate design to the Australian Government’s Future Frigate programme. The future frigates’ maritime warfare capabilities will feature an advanced, integrated underwater sensor suite, as well as enhanced signature management and noise reduction measures.

♦♦ Atlantic premiers and federal ministers to review the Atlantic Growth Strategy’s progress and discuss how they can maximise the benefit of the oceans supercluster in Atlantic Canada.

3. Autonomous Systems

As Industry 4.0 continues to gain recognition, autonomous systems, a rapidly expanding technology has attracted considerable interest from transport applications, particularly in air and automotive transport. As the focus in the marine industry at present is on improving safety by taking people out of the 3D (dirty, dangerous and dull) jobs, a significant rise of autonomous system usage in the marine domain is projected for the future. These systems are maturing and cost, robustness, endurance and regulatory challenges are being addressed by a number of initiatives at an international level.

What we are seeing in the market:

♦♦ Rolls-Royce has signed a deal with Google to develop further its intelligent awareness systems which are making existing vessels safer and is an essential to making autonomous ships a reality. It allows Rolls- Royce to use Google’s Cloud Machine Learning Engine to further train the company’s artificial intelligence (AI) based object classification system for detecting, identifying and tracking the objects a vessel can encounter at sea.

4. Robotics

Assembly, inspection, manipulation, and exploration are some examples of tasks that could be programmed into a robot to conduct operations in many industries, from shipping to space missions—with different levels of independent decision-making can be programmed. Apart from being remotely controlled, robots can also complete complex tasks—either supervised, collaborative, or fully autonomous.

Driven by improving safety, security, and productivity, the widespread adoption of robotics has been observed across various sectors. Recently, industrial robots have been dominantly used by the automobile industry and nearly half of professional service robots have been used by the defence sector. Although small in unit number, the construction industry has seen some of the largest growth in the purchase of professional service robots in recent years. While in the marine construction business, the knowledge of technology will revolutionise the future marine service and and robotics will become an integral part for tasks, especially those conducted in severe working environment, such as deep ocean mining and disaster relief.

What we are seeing in the market:

♦♦ Kleven Industries in Norway, has invested in new robot welding systems that precise and can work 24 hours a day and very quick.

♦♦ Automatic lug welding system with an overhead type robot manipulator developed DSME, South Korea.

5. Blockchain/Distributed Ledger Technologies (DLT)

The great potential for DLT is to be used in improving supply chain processes. Any type of supply chain business, either marine, air, or land-based, can take advantage of the Blockchain / Distributed Ledger Technologies (DLT) system due to its easily adaptable interface and a very low entry barrier to existing systems. The logistics industry can expect better visibility, connectivity and cost savings as a result of distributed ledger adoption across the supply chain. The future potential of this ecosystem platform can clearly identify the problems and co-create applications to solve the collective challenges faced by the industry today.

What we are seeing in the market:

♦♦ Hong Kong-based company ‘300cubits’ has successfully conducted the first trial shipment under its smart contract deployed through its Ethereum blockchain technology. Malaysian liner company West Port and Brazilian textile importer LPR have taken part in the trial.

♦♦ Successful pilot programme, delivered by logistics technology company Marine Transport International (MTI) and summarised in a whitepaper written and verified by the University of Copenhagen and Blockchain Labs for Open Collaboration (BLOC). The container logistics industry will see improved connectivity, efficiency and security.

6. Advanced Materials

Advanced materials refers to all materials engineered to deliver specific physical and/or functional properties in their application. The trend with all metallic, ceramic, polymeric and composite materials is to achieve improved

capabilities such as strength, toughness, durability and other useful functionalities by designing it at the nanoscale and harnessing those properties in large structures.

The structure and properties of advanced materials at the nano scale—i.e. one millionth of a millimetre—is now well understood, and this is leading to the challenge of manufacturing advanced materials to realise capabilities in bulk structures. Termed as nano-engineering and the materials are referred to as nano-materials, the research and commercialisation of nanomaterials will continue to accelerate and large-scale structures with increasingly refined and reliable properties are expected to be in use.

Desirable functionality, such as environmental sensing, self-cleaning, self-healing, enhanced electrical conductance and shape modification, is anticipated through the development of nano-materials, and, in turn, will deliver performance benefits in the commercial shipping, naval and ocean space industries.

What we are seeing in the market:

♦♦ The Realisation and Demonstration of Advanced Material Solutions for Sustainable and Efficient Ships (RAMSSES) project involves 36 partners from 12 countries, which began working together in June 2017. This project’s overall aim is to develop an all composite ship hull which will measure around 70m in length, which will then be subject to testing under real-life conditions on the high seas.

7. Advanced Manufacturing

The development of innovative technologies and materials, coupled with the rise of consumer demand, has led to a transformation in manufacturing processes and more importantly, its economics. Technologies such as additive manufacturing, coupled with the use of robotic systems for assembly, offer the opportunity to bring back manufacturing to high-value economies through increased productivity and competitiveness.

The key to this change is the ability to exploit and integrate adjacent technologies and business innovations, including: informatics which will apply information techniques to the manufacturing and logistics processes; automation and intelligent systems which will enable increased productivity, safety and quality; and simulation and visualisation techniques which will reduce the time from conceptualisation to production.

Manufacturing-technology developments are enabling high levels of innovation in all aspects of product development and support, reducing costs, weight and complexity. In the long term, these developments will enable the production of components and products on or near their point of use. As the technologies develop, the size and complexity of components are expected to increase. Trials are already underway to conduct 3D printing onboard ships and future developments such as 4D printing, coupled with nanotechnologies and robotics, are expected to lead to the printing of autonomous vehicles that can suit specific mission needs.

What we are seeing in the market:

♦♦ The first fully 3D printed ship propeller has been approved for use and completed by a team of engineers in the Netherlands. Known as the WAAMpeller, it was unveiled at the Damen Shipyard Group’s headquarters in Gorinchem. The completion of the world’s first 3D printed ship propeller shows the direction that the industry could soon be heading.

♦♦ Index AR Solutions, an augmented reality pioneer in the United States hails its teaming partner, Newport News Shipbuilding (NNS) turning to VR in exploring a new tool called ShipSpace that allows designers, engineers and stakeholders to validate design ideas and communicate effectively about vessel concepts.

8. Human Augmentation

Human augmentation has made considerable advances in terms of enhancing both physical and cognitive human capabilities which include power assisted suits or exoskeletons that enable paraplegics to stand and walk; ocular sensory substitution devices to enable improved vision; and cochlear implants to enhance hearing.

The field of human augmentation extends beyond the use of prosthetics and exoskeletons to include bionic implants (referred to as ‘bions’) and the development of drugs and administrations that can enhance human biological functions. Alongside these developments, work is also focusing on ‘neuro-enhancements’ to enable superior memory recall or speed of thought.

Human augmentation’s promise of improved human performance and the need for future navies to operate more effectively with fewer crew members will drive the technology’s adoption. Exoskeleton technology is expected to be at the forefront of this adoption, but intrusive bions and neuroenhancements will appearmuch later as they generally augment human strength only rather than replacing it and tend to enhance one part of the body . Without external power, exoskeleton technology can deliver a 10-20 percent boost to the user’s lifting power by transferring weight to the ground.

What we are seeing in the market:

♦♦ In Japan, exoskeletons are being used for heavy lifting in the shipbuilding industry as well as in large commercial construction projects.

9. Clean Energy

Energy management refers to the efficient production, storage, delivery and re-use of energy onboard vessels at sea. The technologies associated with the whole energy management system are particularly important in naval vessels where the demand for ‘high-capacity surges’ from energy intensive systems will continue to grow between now and 2030.

In energy production, the technology will be driven by environmental legislation and the need for lower predictable operating costs, to increase the attractiveness of flexible hybrid-power solutions in which adaptable power architectures can manage electricity generated from both renewable and non-renewable sources. In the future, economically viable small-scale nuclear fusion reactors may also be possible and for energy storage, the development of lightweight, high energy density fuel cells which convert hydrogen into usable electrical energy, will continue.

The delivery and re-use of energy is equally important, and the combination of improved system architectures and the application of more advanced materials will reduce energy losses and consequently reduce heat onboard. Increasingly flexible and adaptable power system architectures will enable improved power availability to allow the rapid allocation of power according to the dynamically changing operational roles and mission dependencies of naval vessels.

Electric-hybrid technology in Finland has now moved over state-owned operator FinFerries, which carries approximately four million vehicles and ten million passengers a year. Shipping industry moving toward clean energy by using energy storage and renewable energy (solar). In the case of Finferries’s Elektra, the 98m-long ferry has 160 lithium-ion batteries on-board, with a combined total output of 1MWh. To further boost the Elektra’s green credentials, it is fitted with several solar panels that feed back into its power system.

What we are seeing in the market:

♦♦ Scandinavia is bearing witness to a new generation of clean, vibration-less and near-silent technologies, thanks to Siemens’ partnerships with national ferry operators.

♦♦ More fuel-efficient diesel engines, hull design and propellers, for example like the one used onboard the Maersk Triple-E class container vessels, designed to facilitate slow steaming or sailing significantly below the ships’ maximum speed —to attain lower fuel consumption by 37 percent and carbon dioxide emissions per container (TEU) by 50 percent compared to its predecessors, the E-class.

♦♦ Fuel celled technology onboard vessels. The world’s first—and thus far the only —commercial vessels with this feature is the Viking Lady, an offshore supply vessel (OSV). It is owned by a Norwegian OSV owner/ operator, Eidesvik Offshore and is being deployed in an oil field the North Sea.

♦♦ Improved heating, ventilation and air conditioning (HVAC) and waste-heat recovery systems that use less energy and produce less emissions.

Conclusion / New Areas

Technology trends will definitely alter business model and propel the SBSR industry to be more competitive in the global market. Although in general, growth is low in any industry adoption of Industry 4.0, the first mover advantage could benefit from early adoption and quickly learn from their experience to be more innovative. Global initiative towards Industry 4.0 will set a new policy and standardisation in the industry for industry players to harness the benefit and reduce risk of the Industry 4.0 adoption.