by | Abdul Razak Ismail, C Eng. FRINA (UK)

Author’s Profile

Abdul Razak Ismail graduated in Naval Architecture & Shipbuilding before returning to Malaysia in 1983 where he built his career to become the Executive Director of Ships Classification (Malaysia) Sdn Berhad.

He has been nominated as the Vice President (Related Marine Industries) of Association of Marine Industries of Malaysia (AMIM) for 2012-2014.

Abdul Razak is also a Fellow of Royal Institution of Naval Architects, United Kingdom (FRINA) and registered as a Chartered Engineer with the Engineering Council of United Kingdom.

A prominent figure in the local marine industry, Abdul Razak is an associate to MIGHT and a consultant to Petronas. Currently he is Managing Director of MCTMS Design as well as Deputy CEO of MTC Floating Solution.

The Ship Building and Ship Repair (SBSR) industry is a strategic industry due to its numerous spill over effects, and is recognised by the Organisation for Economic Cooperation and Development (OECD) as having strategic importance in terms of employment generation, industry capacity, technological capability as well as other benefits (Ref 3). However, the SBSR industry is now in a bearish environment since the oil price dropped by more than 50 percent from its peak of USD 110 per barrel in 2014.

Local shipyard operators, who derive the bulk of their income from energy-related projects, are facing a hard time as oil companies cut down on offshore exploration and production activities amid a slump in global crude oil prices. The effect of the drop in oil price resulted in lesser demand for offshore support vessels that resonated into reduced order book and repair work for these vessels.

For the last 35 years, Malaysia has not achieved being among the key SBSR nations, like China and Korea. This is a curious case considering its dependence on shipping, the number of shipyards it has and the country’s strategic location along Straits of Malacca and South China Sea, two of the world’s busiest sea-lanes.

On the global scene, China is leading in the shipbuilding industry ahead of Korea and Japan. Between the three nations, they represent 85 percent of the world’s order book. Korea started its shipbuilding industry about the same time as Malaysia and in less than 30 years has become the biggest shipbuilding nation in the world overtaking Japan in 2000 (Ref 1).

Locally, attempts have been made to develop and grow the local SBSR industry since the 80’s but the initiatives were not well-coordinated and were only concerted towards one direction. The industry needs were based on locality and thus, shipyards are scattered all over the country. This may be one of the reasons the industry has not been recognised globally and, combined with the wrong business models, has remained the same 35 years on.

Lack of Competitiveness

Currently, there are many issues dogging the local yards that have suppressed its growth and curtailed it from realising its true potential. The SBSR industry is facing perennial issues and challenges of high costs and late deliveries of ships built at local yards which are about 20 percent more expensive compared to other SBSR nations. Many ship owners prefer to build ships overseas; particularly in China which can offer vessels at much lower prices.

Further compounding this, many local yards depend on government contracts, which are usually not subjected to competitive bidding. Despite the various assistances and measures offered by the government, which includes incentives and policies to help the local shipyards, their growth is stunted because the system that they exist in does not encourage competitiveness, affecting their production system and methods. Consequently, they will lose orders to their overseas competitors and the job market in the SBSR industry shrinks when economic slowdown occurs.

During one dialogue in June 2015 between Malaysian and Germany business chambers, the Germans proclaimed that their rapid progress in the SBSR industry is without much government assistance. This scenario is similar for the industry in Norway, as stated by one of the speakers at the recent Asia Pacific Maritime 2018 in Singapore that was held on 16th March. Both the Germans and Norwegians have shown that the growth of their industry is basically driven by internal factors and dynamics of the industry players themselves. The local SBSR industry high dependency on the government may be one of the reasons why they remain, as they are—uncompetitive.

It is not too late for the local SBSR industry to follow the steps of countries like Germans and Norway by increasing our competitiveness through looking inwards at our inherent issues and challenges such as high manufacturing cost due to lots of reworks, repairs, modifications and late deliveries.

Another factor contributing to the lack of competitiveness in the Malaysian SBSR industry concerns the local pool of skilled workers. Our continuous dependence on foreign workers in the long term will not serve Malaysia’s interests. Although the foreign workers are reasonably skilled and command lower wages than local ones, which is to the economic advantage of local shipyards, their dominance in skills based works in the SBSR industry is a future threat as they will go back to their countries with the training and skills they acquired in Malaysia instead of sustaining the local yards.

Lack of incentives offered by the federal and state governments to local yards in developing talents and skills to employ skilled workers among locals is also certainly not ideal for the future of the SBSR industry as it marches towards economic transformation.

Since Jokowi became President, the Indonesian government has implemented various SBSR industry friendly policies including an import duty of 5 percent for ships built outside Indonesia. This action is contrary to Malaysia which has implemented 6 percent GST since 1st April 2015. It is a double blow for the local SBSR industry especially on taxation, making it costs 10 percent to 12 percent more expensive thus not attractive for growth.

Main Challenges

While it is best to leave SBSR policy matters to the government to review and evaluate its impact on the industry, the SBSR players should also learn from countries like Germany and Norway to focuson internal issues and challenges and improve competitiveness in the market.

PRICE, DELIVERY and QUALITY, are the key evaluation criteria applied by purchasers or ship owners when placing orders. The number one determinant is PRICE for low sophistication vessels like oil tankers, bulk carriers, general cargo ships and container ships, followed by delivery and quality. The reverse is true for high sophistication vessels like LNG carriers, passenger ships and oil rigs (Ref 1).

Since the local SBSR industry is focused on low sophistication vessels, PRICE is the main issue and criterion used by local buyers. It is hard to get orders even from local ship owners as the average vessel price is 20 percent to 30 percent higher than neighbouring countries.

The target for the local SBSR industry is to reduce their overall costs, thus lowering the PRICE offered. Internal factors affecting costs being with the costs estimating process which includes the design, procurement, production, testing and delivery of the vessel to its supply chain and value management. Every process chain requires re evaluation for costs reduction, either by adopting a more efficient work process or utilising software and computerised systems. It is pertinent that our SBSR players to improve in these areas of delivery processes.

South Korea’s Samsung Heavy Industry (SHI); one of the three largest ship builders in South Korea, together with Hyundai and Daewoo, has the highest level of automation in the industry at 68 percent. (Ref 2). It has its own Institute of Industrial Technology that continuously carries out research and innovations.

In comparison, the level of automation in the local yards is considered very low with only 15 percent of shipyards in Malaysia operating on a medium level of automation, which is limited to having computerised Numerical Control Cutting (CNC) machines and auto blasting shops. Other production processes, such as welding, onsite blasting and painting remain unchanged for the past 35 years. One of the often-quoted reasons is, our country has abundant cheap labour that negates the advantages of automation, which is highly capital intensive. Ironically, we remain uncompetitive despite the cheap labour costs. It is highly recommended that we follow the competitors’ business model for us to be able to offer a more competitive vessels pricing.

Industry 4.0 in SBSR

The most common question posed in the local SBSR industry is the level of readiness to adopt Industry 4.0. Speakers at the recent MITI Day National Services Sector Summit 2018 held on 27th February, expressed their doubts and stated that the local SBSR industry is not even Industry 2.0 ready. To assimilate Industry 4.0 in the local SBSR industry, we need the willpower to innovate, adopt, and adapt to new technology. The key nations of SBSR industry are already embracing the move towards Industry 4.0, especially in Korea followed by USA, UK, Australia and Spain.

For our local SBSR industry, the low capital competitive business model available now does not require automation beyond using CNC, thus the industry players remain clueless on facing Industry 4.0. However, with the application of Industry 4.0, automation can be increased and implemented seamlessly throughout the supply chain, thus making SBSR industry more cost effective.

Flaws of 2D Design

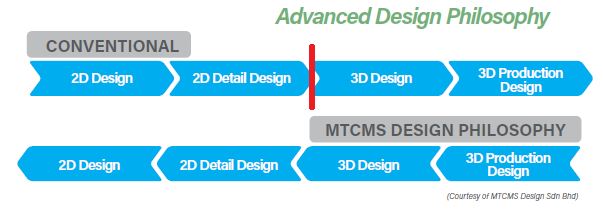

Another process in the SBSR industry that has remained unchanged for the past 35 years is the design approach and practice. Designers engaged by the local shipyards are still using the 2D design system and drawings despite the advent of super-computers and availability of powerful software and big data library.

Studies have shown that the 2D design system has many flaws. First reason being, it is very hard to detect ‘clashes’ of systems between vessel systems such as piping, HVAC, electrical and structure. The ’clashes’ during construction of the vessels will result in modifications, repairs, reworks and wastage of material and man-hours, which will trigger delays. Shipyards will usually be charged a penalty for delays and late delivery, adding on to the overall costs.

Secondly, the method of ship construction is unchanged whereby the modular method that was introduced in lecture rooms more than 40 years ago cannot be implemented by local shipyards due to the current 2D design system applied. The local shipyards never gain the advantage of the modular construction method and thus, production time are not reduced.

Thirdly, the 2D design system is unable to provide accurate estimates of materials such as hull and piping for the yards to purchase. It is often overestimated plus 10 to 15 percent contingency margins, resulting in unnecessary costs that need to be borne by vessel buyers. Another example is the wastage due to ship plate nesting with conventional 2D design, which adds 6 to 10 percent more than the optimised nesting of a 3D design solution.

And lastly, is the compromise in quality. With repairs, reworks and modifications during installations of systems (piping, HVAC, etc), the welding quality will not be the same as the work done in the workshop.

Corrosion preservation quality is compromised due to restricted work area for surface preparation and coating application.

The final drawback from 2D drawing is the tedious and time-consuming process shipyards must undergo when creating a partial production drawing. This expensive exercise from conventional 2D approach often defeats the purpose of production design, which is meant to reduce production time.

3D Design & Technology for Application of Industry 4.0

All the flaws of 2D design can be overcome by adopting the 3D design system, which includes all the systems on board the vessels such as structures, piping, electrical, HVAC and safety. Currently, this 3D design system is not offered by any ship designers in the region, including Singapore, except one home-grown designer based in Kuching, Sarawak, named Mega Salutes Ship Design Sdn Bhd (MSSD). It took four years of development by MSSD to finally release their first complete 3D design system for a 45.5m landing craft in 2014.

A case study of 61.82m AHTS (Anchor Handling Tug Supply) vessel designed in complete 3D systems by MSSD and built by Sapor Shipyard in Sibu, Sarawak reveals the followings, compared to the traditional 2D design system:

♦♦ 60 percent Reduction in Production Time

♦♦ 50 percent Reduction in Man hours

♦♦ 6 percent Reduction in Steel Wastage

♦♦ Approximately RM 4mil Direct Costs Saving

A preliminary exercise carried out with a local shipyard indicates that a total saving of 20 percent is achievable by using the 3D design system. Thus, our local SBSR players can reduce their costs and increase competitiveness to the same level as the yards in China.

More savings are achievable when the 3D design system is adopted by our SBSR industry and implemented in a Industry 4.0 environment. Since the 3D design systems complete the detailed production design before the project starts, quality is built into the production process from the design stage. Mismatches of system resulting in repairs, rework and modification is minimised if not eliminated totally. This will subsequently reduce production time and vessels can be ready to be delivered on time or even earlier.

Other benefits of complete 3D design systems are, but not limited to:

♦♦Robotic welding made possible by using 3D design

♦♦3D Virtual Reality (VR) walk through in the vessel before it is built

♦♦Design for maintenance (data easily retrievable for maintenance purposes)

♦♦3D VR model can be used for training of ship’s crews, as well as for inspection during vessel construction

♦♦Errorless approval drawings from drafting errors and amendments

♦♦Accurate engineering analysis with powerful visualisation

♦♦Precise Bill of Material rather than using estimates

Other technology for the application of Industry 4.0 in local SBSR industry is:

♦♦Use of virtual towing tank for vessel performance analysis

♦♦Hull form optimisation and performance evaluation using CFD (Computational Fluid Dynamics)

♦♦Hull structure optimisation using Finite Element Analysis(FEA)

♦♦Smart ship system

♦♦Remote and autonomous ship technology

With the use of advance computer analysis and state-of-art engineering tools in Industry 4.0, the definition of ‘proven hull’ as stated in proposal documents can be redefined as ‘proven design by engineering and analyses’.

In summary, 3D design systems as proposed by MTCMS Sdn Bhd (MTCMS) will enable the local SBSR industry to implement Industry 4.0 at a minimal investment, making the local yards more cost effective, increase productivity and quality, and greatly improve overall competitiveness. In return, the local yards will secure more orders, generate higher revenues, penetrate overseas markets and provide growth for the industry.

Industry 4.0 will propel the local SBSR industry to gain competitive advantage over their competitors through locally developed 3D design system as an enabler. The future of the local SBSR industry critically depends on Industry 4.0 and 3D Design technology to be able to give customers quality, and competitively priced vessels in a timely manner. To achieve this, there must be a conducive and technologically advanced environment to fast-track its growth and development into Industry 4.0.