by | Mizuan Abdul Manaf, CEO UTM Holdings Sdn Bhd

Ocean Thermal Energy Conversion (OTEC) in Malaysia can be considered a “blue ocean” sector and a potentially disruptive technology that can eventually affect the existing Malaysian energy industry and its value chain. Therefore, getting the attention of investors requires a holistic approach whereby the journey from idea to revenue generation – followed by strategy on sustainability and growth – must be clearly detailed.

The energy demand for electricity and transportation in Malaysia is estimated to be approximately 20,000MW and 25,000MW respectively. OTEC can definitely play a big part with its potential for installed capacity of more than 50,000 MW. Designing an OTEC Power Plant from concept to completion is very modular and can be integrated to suit the identified site. The whole supply chain can be easily established to assure investors that nothing will be left out from resource to production.

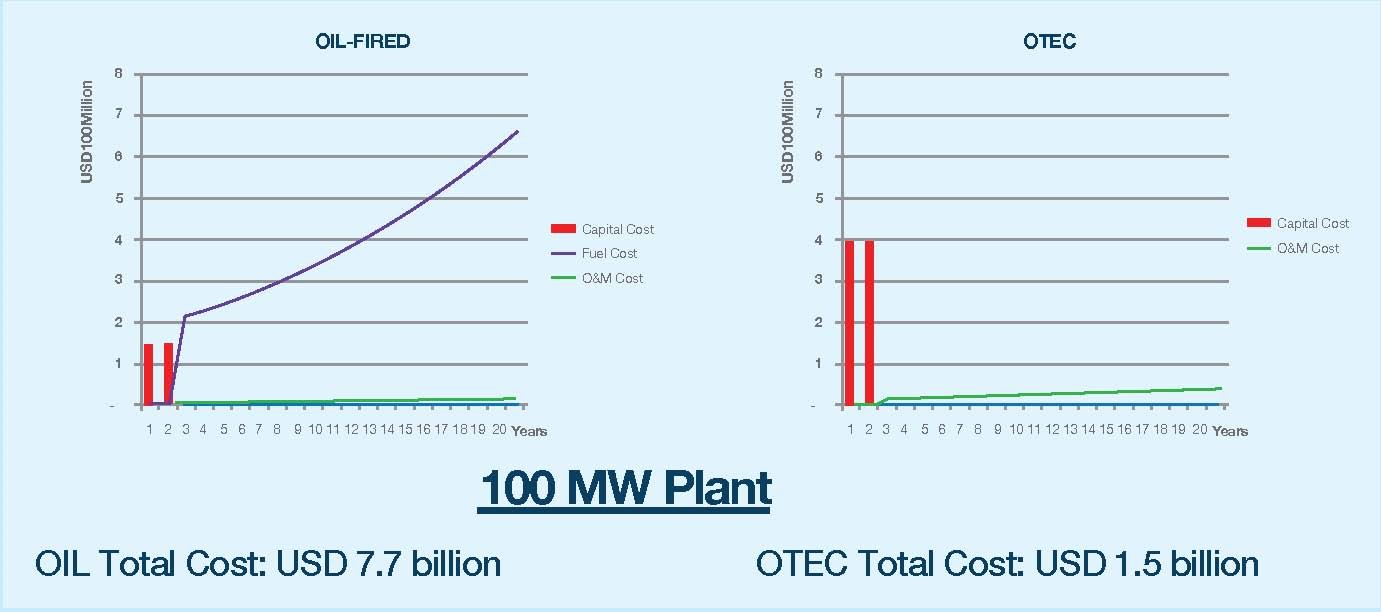

The OTEC Power Plant business model and financial projection are very similar to typical power plants, which are mostly fuel powered. Nevertheless, investors need tolook at the total life cycle cost and be less critical of the initial capital expenditure. By comparing total life cycle between OTEC and a Fuel Powered Power Plant, we shall see that even though OTEC capital expenditure appears to be 2.5 times more, the total life cycle costs indicate that OTEC saves US$6.2 Billion / 100MW. This is due to the fact that OTEC is not fuel dependent and therefore, not affected by volatile fuel costs.

OTEC Power Plant has two primary products: Electricity and Hydrogen. Since most of OTEC potential areas in Malaysia are relatively far from the shore, the main customers for electricity are the Deep Sea O&G Platforms. Hydrogen demands shall be from the fuel cell industries such as transportation, smart-grid and data centres. At this point however, it is important to note that the OTEC Power Plant in Malaysia should not be designed to compete with the existing energy carriers but rather to complement them. For example, OTEC Power Plant can help solve current energy issues such as peak hour electricity demand, remote area power supply and replacement for subsidized transportation fuel.

The secondary OTEC Power Plant by-products are potable water and recycled deep-sea water (DSW). While the former can be used for consumption at deep-sea O&G platforms, the latter is very valuable for its relatively chilled temperature and high nutrient content. Proven DSW usage in cooling systems and cultivation of aquaculture and agriculture can be seen in Hawaii and Japan.

It is always challenging to start up a venture and get returns quickly. It is even more challenging to sustain and continuously grow the business. That is why investors do not normally stop at being convinced with just the feasibility and viability studies. For venture like OTEC Power, investors also look for the “essential values” that strengthen and protect the venture.

These essential values can take the form of patented Intellectual Properties within the integrated modules of OTEC Power Plant (i.e. Turbines, Heat Exchangers, Membrane, Integrated Design and Controls System). Strict NDA with principal manufacturers and the whole OTEC supply chain can be part of the essential values as well. Another important value is strong equity partners and, to a certain extent, the involvement of the principal manufacturer and/or EPCC contractor. Finally the most crucial value to investors is government support and involvement in the venture in the form of a comprehensive Malaysia OTEC Act and Policy.

It would be an additional bonus to investors if the venture is able to contribute via royalty/savings and Green Technology spin-offs respectively. Spin-off companies and job creation throughout the supply chain of fuel cells and DSW byproducts would definitely have a great impact on the venture as well.

Distinguished Participants @ EWC-EAPI Workshop on Shipping Energy & the Environment, Honolulu, November 1981