by | Anuar Mohd Nor

The first road map for shipbuilding & ship repair (SBSR) industry called ‘Malaysian Shipbuilding/ Ship repair Industry Strategic Plan 2020’ (SBSR 2020) was launched in 2011 by the Prime Minister of Malaysia, Dato’ Sri Mohd Najib Tun Abdul Razak.

The road map is to guide the SBSR industry’s development and strategically propel Malaysia into becoming a high-income and developed nation. With strategic targets sets in the SBSR 2020, the industry aims to generate RM6.35 billion in the Gross National Income (GNI) and provide 55,000 jobs through growth that is both sustainable and inclusive. The targets set may appear ambitious but they are reasonable. They play up to the strength of Malaysian shipyards which are competent in building small and medium size vessels some of which like offshore support vessels (OSV), passenger ferries and leisure crafts – are even coveted abroad. The targets also reveal the huge opportunities for local shipyard operators to reap the potential in the SBSR industry.

In realizing the aims, several strategies have been put forth which include strengthening the institutional framework, establishing business friendly policies that support the industry growth and reinforcing regulatory frameworks to assure that the integrity of SBSR companies and the quality of their products continue to improve. In term of human capital development, an adequate and capable workforce must be provided and at the same time develop our design capability that adopt new SBSR technologies. Inward investments are also being actively sought through improved financial and incentive packages. The industry’s level of sophistication as well as its competency needs to be upgraded for optimum results. The SBSR industry is influenced by many internal and external drivers that affect its development and direction and the strategies of shipyards and ship owners alike. These drivers encompass a host of areas such as policies, environment, economics, technology, financing, consumption, logistics and even geostrategic developments. They affect how ships are built, owned, financed, deployed and eventually scrapped. Beginning mid-2014, the fluctuation of the oil price has relatively determined the path of the local SBSR industry. The drastic dropped in oil price towards end 2014 and beginning 2015 have risen concerned among the shipyard operators. PETRONAS recently had announced to defer its Capital Expenditure (CAPEX) and reduce its Operational Expenditure (OPEX) in response to the recent steep 60% decline in oil prices. The deferments would reflect the change of environment in the global O&G industry to ensure its resilience through the low oil price period.

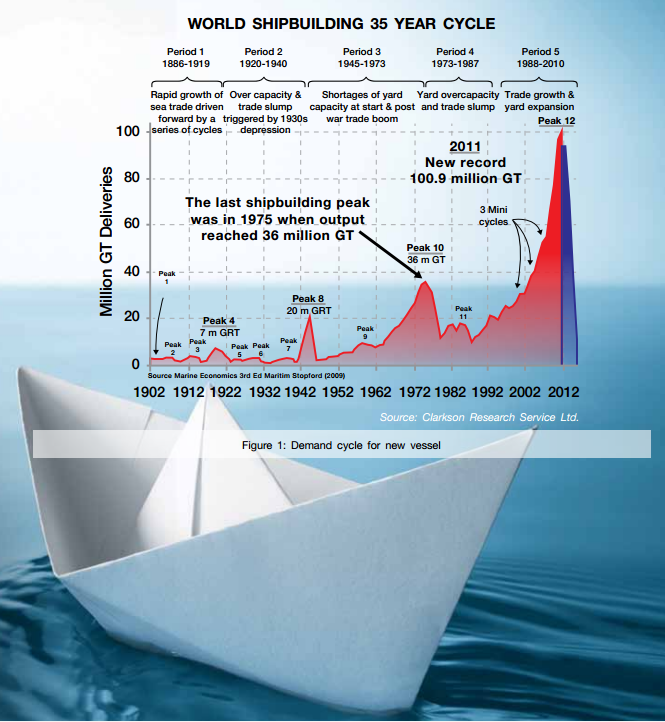

It is a known fact that the strength of O&G sector has been one of the key factor that determining the local SBSR market force. Shipyard that have diversified their business focus into O&G offshore engineering and fabrication from the usual building and servicing vessel during the O& peak cycle, might be the one being affected most. Despite the turmoil, it is noted that the local demand for OSV type vessel remained stable while there was a significant drop in orders for other types of vessel after having reached its peak in 2012. In general, the demand cycle for new vessel is shown in Figure 1.

Since the launching of SBSR 2020, several initiatives as recommended have been implemented though some of them were unable to progress further amid various reasons, including the unfavorable policies that are already in place. In response to the growing expectations for the government to support the SBSR industry, it is imperative to align the government development plans with the needs of industry. Leading to the right direction, Ministry of Industrial Development, Sarawak had responded positively on the issues raised and realized business potential that can be tapped from the SBSR activity with focus in Miri and Sibu. Henceforth, the industry players need to continue to work closely with the state Government to further develop the industry so that each party can play a strategic role in contributing to Sarawak economy.

It is a known fact that, Malaysia has been one of the vessel exporters to Middle East countries such as UAE and Qatar. The demand of offshore vessels type by these countries is due to their rapid growth in exploration and production on the O&G sector. As such, a continuous effort that spearheaded by Malaysia External Trade Development Corporation (MATRADE) to intensify global marketing is definitely be the right move they made. Through its specialized marketing mission, the aims is to expand business opportunities in the targeted market focusing on marine products such as new build vessel, marine equipment, maritime training and in engineering services.

The development of the SBSR industry must also taking into consideration the development of its workforce capability. As such, an appropriate modules and subjects that applicable to SBSR industry with emphasis on problem solving, multi skilling and safety consciousness must be laid down. Engagement with experts as well as those who are hands-on on that particular job would be the best approach in coming out the best training modules. The objective is to flood the industry with Malaysian talent thus phasing out our dependency on foreign workers. On another initiative, a skilled worker will be developed under a customized bridging programme whereby these peoples will immediately absorb by industry upon completion their training programme.

One of the key strategies to spur the development of the industry under the SBSR 2020 is by applying local design and adopting new technologies. Currently, most of the designs used for new build in Malaysia are imported from other countries; mostly from across the causeway. Boustead Heavy Industries Corporation Berhad (BHIC), has taken up the challenge by embarking a project under the Economic Transformation Programme (ETP). The project of developing local OSV design arises with the objective to increase Malaysian share in shipbuilding while increasing the local content and develop local vendors. The ability to own the design data would enable future upgrading and modification to be carried out locally. This would, in turn, encourage research and development activities and lead to innovation in generating new designs.

The high technology industries such as SBSR can be further developed by injecting foreign expertise that allows for knowledge and technology sharing in niche areas. To improve efficiency particularly in ship repair project, BN Shipyard (BNS) has engaged Korean expert to provide an advisory services. The objective is to further enhance the shipyard potential by injecting foreign expertise that allows for knowledge and increase productivity. With the engagement, BNS is able to acquire the appropriate shipyard practices in improving their delivery time. Based on the success of this initiative, the same module will be emulated to others SMEs thus provide them a wide exposure on the South Korean best practices.

In accordance to the world environmental protection on air and water, the newly imposed rules and regulations by the International Maritime Organization (IMO) had indirectly given impact to the vessel production in Malaysia thus raise the operational cost to the ship owner. The requirement of latest technology, for example on the main propulsion system that complies with the new IMO regulation on gas emission will force the ship owner to revise their investment plan for new vessel. The infusion of green features onboard ships have exerted demand on naval architects, marine engineers and shipyard operators to accommodate the need to design environmentally friendly ships. This entails investing in state of the art equipment and technologies and also introducing innovative solutions to build eco-friendly, fuel efficient and economically viable vessels that comply with regulatory requirements and operate efficiently.

Industry Performance

Since 2010 until mid-2014, the O&G sector remains favorable after experiencing a lows cycle in 2008/ 2009 underpinned by high oil prices and major projects by local and international players. O&G sector is one of the strongest driving forces for the local SBSR industry. Due to this fact, shipyards have enthused to diversify their business operation apart from SBSR into activities that support offshore requirements such as structure fabrication, ship conversion (i.e. Floating Production Storage and Offloading, Floating Storage Offloading etc.), rig building, platform repair and maintenance and even ship chartering.

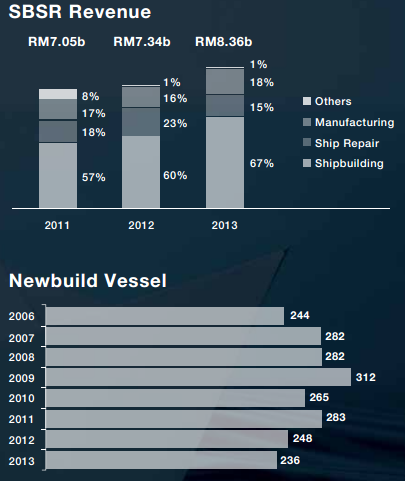

In overall, Malaysian SBSR industry stayed strong with 2013 revenue recorded at RM8.36 billion; an increment of 14% compared to 2012. The figure is commensurate well with the total number of workforce in the industry, which estimated at 35,000 employees. It should be noted that the number of workforce is exclude subcontractors for works that being outsourced by shipyards. Therefore, the actual number of total manpower in this industry could be higher.

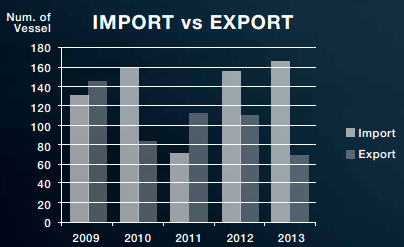

It is an alarming fact that the number of imported vessels continues to increase which had reached to more than 100 per cent, based on calculation made for 2011 to 2013. Surprisingly, most of the imported vessels are of near coastal types which are less complicated, low in value and within local shipyards capability. As a result, local shipyards managed to capture only 50 per cent of local market needs compared to 70 per cent in 2011. The inability of local shipyards to meet the requirement of delivery period and offering competitive price were believed to be the key factors in the high number of vessels being imported. Although imported vessels are comparatively cheaper, they are often of lesser quality. In some cases, these vessels that uses lower quality material and products is compromised by the ship owner’s even it only give them a short term advantage in term of cash flow. Attractive financing terms offered by overseas lenders is also a contributing element for ship owners to prefer acquiring vessels from the foreign yard.

Export wise, the year under review also recorded a drastic dropped from 113 vessels exported in 2011 down to 70 vessels in 2013 though the total of gross tonnage (GRT) remains unchanged. The downtrend in number of exports clearly indicated a lower demand as well as stiff competition from other shipbuilders in this region.

Low freight rates that consecutively it becomes uneconomical to operate a vessel continue to weigh down the ship repair market. Revenue gained in the ship repair was largely from activities that involved in servicing bigger and special purpose vessels such as LNG carriers, containers,tankers and bulk carriers undertaken by MMHE in Johore.

Although the ship repair sector provides a steady business flow, there is a huge need to upgrade shipyard facilities and provide better quality in services in order to capture the local and international market. The current capacity of docking facility available at Peninsular Malaysia is at the range of 300 to 10,000 GRT and mostly located along the west coast. With these capacities, it should not give any problem to dock a vessel of small to medium size, the size that currently dominating the Malaysian waters. East Malaysia has the potential to become a regional hub for ship repair in term of number shipyard available. However its geographical constraints such as shallow river depth and strong river currents are some of the major challenges that need to be resolved fist in order for it to be easily accessible by vessel.

In 2013, marine equipment manufacturing contributed about 18% of SBSR industry revenue worth RM1.5 billion; figure that populated from 26 companies. Most of the companies involved in producing electrical and electronic parts and component, auxiliary equipment and deck machineries.

Consist of raw material and subcomponent in Tier 4 up to Prime Contractor which represented mainly by shipyards. Except for marine grade steel plate, the current manufacturers in Tier 4 have no issue to provide raw material used in shipbuilding.

Comparing to other players in this region, our marine manufacturer can also produce a high quality and reliable products at a very competitive price. Some of these manufacturers even export their products to international market. Nevertheless, the opportunity for a bigger market share is there to reap if the players can upgrade most of their products into marine grade or standard. Some of the non-high tech auxiliary equipment that manufactured locally are not being certified by the international classification body which limits their ability to penetrate global market. In sub-system equipment manufacturing, the number of local players are quite limited in area of electrical and electronics specifically in navigation, communication and control and monitoring system. These systems usually come with the equipment that is normally imported in a complete assembled form, directly from OEM or through its regional authorized dealer.

Opportunities and Challenges

The changing dynamics in the SBSR industry arising from key trends and developments are profoundly shaping the landscape of the industry. They influence the way ships are financed, designed, built, operated, serviced and even decommissioned. Demand on several types of OSV vessels is predicted to rise in 2015 and 2016. OSV Owners Association Malaysia had projected that around 200 OSVs will be required to facilitate the activities of Petronas and major oil companies and the other oil major companies operating in Malaysia water for the next fie years. These present huge opportunities for local shipyards to meet the needs and match their investment.

On the other hand, industry performance for 2015 and 2016 as a whole might also remain stagnant due to the recent instability of oil prices. If the prices keep in low trend for the next couple of years, the global economy is then expected to experience a slow growth and will consequently affects the number of new build order as predicted earlier. Local shipyards are strained to offer vessels at the lowest profit margin in order to ensure continuous project in hands. ‘Build-to-stock’ business model is seen to provide better returns during these critical years, although it may contribute to oversupply of vessels. However, instead of keeping the vessel as a liability, shipyards or ship operators can bid the vessels, generally at a very low rate.

The local SBSR industry is also dependent on O&G development projects from regional players like India, China, Vietnam and Indonesia and their shipping policies. Effective from 2015, Indonesia’s Cabotage Policy will start to restrict foreign vessels to operate in their waters especially to those that involved in O&G sector. The country is also in the process of formulating policy of cially hiilt’ under their Beyond Cabotage Program. This would reduce the new number of order book from Indonesian customers. The number of local production and export will indirectly decrease as well.

On average, more than 50 per cent of vessels in the world are 20 years and above which creates high potential for newer vessel to replace the timeworn ones. Apart from lowering operating cost with newer vessels, ship operators are also looking for more sophisticated vessels for usage. The industry must also comply with stringent maritime safety and security regulations. Tightened environmental standards require shipyards to produce more environmental friendly and greener, fuel-efficient vessels or eco-tonnage vessel. This creates opportunities for cleaner, safer and more efficient products in the industry. In the O&G sector, limiting the vessel age to less than 10 years only and the tendency by major oil companies to use vessel that can perform a multifunction task will certainly create an opportunities for the shipyard in meeting the new demand.

These trends and developments present many challenges for industry players to overcome and adjust to but also exciting opportunities to reap. To thrive in the fast changing SBSR industry, shipyard operators must put in place adequate resources, infrastructures, capability and support services. In addition, policymakers must be in tune with the trends affecting the SBSR industry in order to be responsive to the changes they bring. This is crucial given that the SBSR industry is important to the well-being of nations and that shipyards can only flurish in this capital-intensive and challenging business landscape with strong policy support and incentives from governments.

Sailing Ahead

Moving forward, the SBSR industry in Malaysia will continually grow based on the recommended systematic changes as tabled in SBSR 2020, which includes commitment by the local shipyards to improve their productivity, efficiency and upgrade in technological capability. As Malaysian SBSR industry is part of the country ETP, it should continue to receive strong governmental support in propelling the industry to the next level. Several strategies have been put forth as part of the national agenda through 11th Malaysia Plan 2016-2020. The main focus is to develop on niche market and migrate from traditional way in SBSR and component manufacturing activities into using high technology equipment and method and produce higher value added products.

It is also crucial for the private as well as public sector to start investing in developing and nurturing the manpower to cater the high-end, specialized and revenue generating activities instead of continue engaging foreign expertise. Building our capacity and capability in Maintenance Repair Overhaul (MRO) activities on high value component e.g. for main propulsion system, navigation system, electronic control and monitoring as well as systems integration must be encouraged.

With all the stakeholders in the industry working in concerted effort, the aim of making Malaysia a significant player in the SBSR industry can be realized sooner than later. There is much promise for the local industry to attain greater heights. Malaysian yards have what it takes to enhance their business and market shares, given that some of them are already undertaking big and sophisticated jobs, especially related to the offshore O&G sector. Greater support from the government and stakeholders such as the shipping community, players in the offshore O&G industry and government linked companies (GLC) will help push the SBSR to greater heights, and help shipyards reap the opportunities presented by the golden era in Malaysia’s offshore O&G industry.