by | Datuk Zulkarnain Mohamed, Spirit Aerosystem

The advent of new manufacturing techniques, advanced metallic and ceramic materials, and the increasing use of composites will mean that the aircraft factories of the coming decades will be very different from the ones we see today: and that will affect not only the way the aircraft they produce look and operate, but also the type of skills that people who work there.

Malaysian aerospace industry was focused on airline operations and maintenance services until the fist serious breakthrough for aerospace manufacturing in the early 1990’s with the introduction of aircraft production such as Eagle Aircraft, MD3 and later the Lancair aircraft. Using the experience from MRO, the capability that we have in engineering and technical skills was then brought up to thrust the industry into aerospace manufacturing.

The three aircraft ventures produced mixed successes. It did open up the door for commercial aircraft component manufacturing which is now one of the main pillars for aerospace industry in Malaysia. Taking the impetus from the success, the fist National Aerospace Industry Blueprint was launched in 1997. It paved the way, or as the theme of the blueprint suggested, ‘taking off’ to further develop and grow the aerospace manufacturing sector.

In recent years, aerospace manufacturing has become one of the fastest growing sub-sectors in the Malaysian aerospace industry. Spirit Aerosystems, SMEA, Upeca and CTRM are among strong players of aerospace manufacturing in Malaysia, and the ongoing initiatives are actively pursued to develop the local supply chain and vendors and establish local capabilities at tier 2 and tier 3. While encouraging local players to expand their capability and capacity, Malaysia is aggressively promoting global players to invest in the country or to establish partnership with local companies. By having more major ‘anchor’ company, the industry can start to grow out from these foundation companies.

The aerospace manufacturing in Malaysia today is based on both metallic and composites details, and assemblies. The participating companies have established and gained trust and recognition from the customers in understanding the nature and requirements of aerospace industry, and producing high quality products. Consistencies in Quality, Cost and Deliveries are crucial to gain the trust of the OEMs and ensure continuous incoming business.

Malaysia is practically involved in most of the important commercial and military transport program for both Airbus and Boeing. Current programs includes the high rate single aisle A320 and B737, Long range and twin aisle B767, B777, B787 and A350, the largest commercial aircraft A380, and the latest military transport aircraft A400M. Components include details and assemblies of flt panels to highly complex ribs and fan cowls.

Competition

While we are still strengthening our presence in the global supply chain, there are competitions from both developing and developed countries. Developing countries are aggressively pursuing the aerospace business, offering lower cost manufacturing; whilst developed countries are actively pursuing technology to compensate for the high cost. The aerospace industry in Malaysia needs to propel itself to a level where there is a balance of technology and labour content. The industry should drive Technology and Labour to converge, and offer a value for money solution that is attractive for the OEM and tier 1.

Advancing Technology through R&T

To achieve the balance, the local industry needs to be engaged in advanced material and processes technologies. New technology and methods in machining, treatment processes, automated assembly and composites manufacturing are available and should be advanced further in the country with the assistances from agencies and institutions. Agency such as AMIC with R&T capability should be fully utilised to engage the right technology partners.

“Currently the Malaysian industry is a technology recipients who built-to-print, where the manufacturer produces products, equipment, or components according to the customer’s (OEMs) exact specifications.”

At the component sub-assemblies and assemblies, some level of automation is necessary. But we still need to leverage on our labour cost advantage. Semi automation may provide flexibility whilst ensuring quality and integrity of components assembled.

Composites have become indispensable in aircraft construction and their importance is growing in the aerospace industry. The processing of composites generally places high requirements on technology development.

One of the major challenges in composites manufacturing is to reduce the dependencies on autoclave processing. Autoclaves are expensive and recognised as one of the main restrains for new companies to start in composites manufacturing due to the high initial investment required.

Several out of autoclave processes such as Resin Transfer Moulding and Vacuum Assisted processes have been introduced, but not enough resources and money has been spent to further develop and make them successful alternatives to autoclave processing.

Moving forward

To move forward, we need to create capacity, capability and resources. Malaysia aims to be the number one in aerospace manufacturing in this region by 2030. To achieve that goal, we need to double the volume and attract more high value packages.

Malaysia can be very competitive in providing solutions at the subassemblies and assemblies level if our industry players can consolidate and form a consortium with strength provided by each entity to create a value proposal to the OEM and tier 1. How much are we willing to invest in creating new capabilities and additional capacities? How much initial government support is available?

“Several out of autoclave processes such as Resin Transfer Moulding and vacuum Assisted processes have been introduced, but not enough resources and money has been spent to further develop and make them successful alternatives to autoclave processing.”

How much are we willing to invest in creating new capabilities and additional capacities? How much initial government support is available?

Through the Malaysian Aerospace Council (MAC), coordination of the industry allows the players to talk to each other, sharing a bigger cake instead of slicing it smaller. Direction as provided in the new Blueprint should be used as a guide for the industry.

The industry needs to create and nurture more tier 3 companies with capacity to provide strong support for the upper tiers. It should not be seen as a competition to the upper tiers, viewed as the supporting structure to grow bigger.

The global industry target is to reduce the manufacturing cost. Local companies should take this challenge and realise that the contracts, when awarded, are for long period; and commitment is mandatory to remain competitive. To start a business in aerospace might be challenging due to high investment with long payback time but, in the long run, being in the game creates the perception of quality and reliability which open more doors to other businesses.

As for human resources, we have produced enough talents for the aerospace industry. The previous Blueprint has successfully promoted the training and education areas, and provides ample high class infrastructures and facilities. Annually, around 50 to 100 aerospace engineers graduated from the local universities. However, do we have enough opportunities for these graduates to serve in this industry? The current situation where the cycle of hiring fresh engineers for (at least) every 3 years has caused those new talents to either serve in other industries or work abroad.

At the same time, the industry requires more technicians. Therefore, institutions such as MLVK, ADTECH and MARA are important to provide training and apprenticeship.

The industry has an ample number of professional talents for the current work load but these talents, especially design and process engineers, require more exposures and experience.

Currently the Malaysian industry is a technology recipients who built-to-print, where the manufacturer produces products, equipment, or components according to the customer’s (OEMs) exact specifications. That is why R&T requires more drive and push towards commercialisation so the industry can be elevated to an OEM environment where we own the design and Intellectual Property.

Malaysian Aerospace Manufacturing: the next 15 years

The new Malaysian Aerospace Industry Blueprint 2030 targets Malaysia to lead the Aerospace Manufacturing sector in this region. This is achievable through close knitted cooperation between Government Ministries, Agencies and, importantly, the industry.

The Government has introduced initiative such as the new Entry Point Project (EPP), known as Growing Large Pure Play Engineering Services, to create an aerospace engineering services company that is globally competitive and able to attract more high-value engineering services work to Malaysia. It is believed that the EPP has the potential to contribute an additional RM1.75 billion of GNI and create approximately 5,750 jobs in 2020. Another EPP introduced is the creation of SME industry to support the aerospace manufacturing.

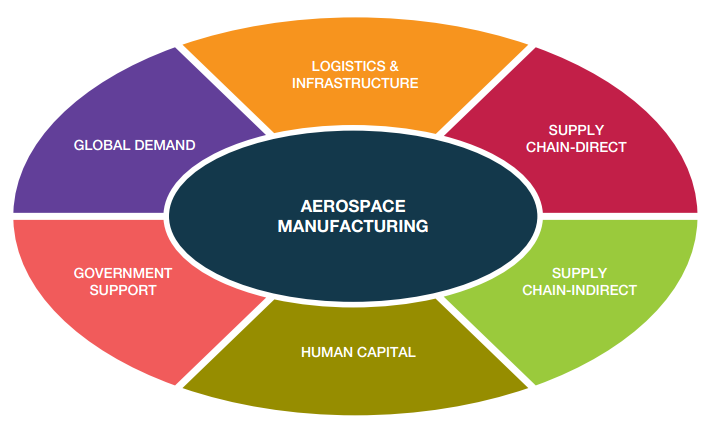

Capacity and Capability build up, together with the engineering development, is essential in attracting new and large work packages. Equally as important is creating the ecosystem to fuel and sustain the growth. A support system in managing the supply chain, logistics and infrastructure, and human capital needs to be strong.

Securing work in the next generation aircrafts is simply a must for the industry to grow and sustain in Malaysia. New aircrafts programs to replace the current design should be starting in the early 2020, and our aerospace industry has fie years or to grow, develop, and to be ready.